Business

ChainUp Obtains SOC 2 Type 1 Certification

ChainUp, global blockchain technology solution provider, has announced its successful completion of the System and Organization Controls 2, audit and is now SOC 2 Type 1 certified. As a key industry standard for compliance, SOC 2 examines the security, availability, confidentiality, processing integrity, and privacy of customer data across solutions. Conducted by Deloitte Touche Tohmatsu Certified Public Accountants LLP, the audit included an evaluation of ChainUp’s internal controls related to Information Technology, based around the Trust Principles of Security, Availability, Integrity of processing, Confidentiality and Privacy in accordance with the criteria set by the American Institute of Certified Public Accountants (AICPA).

As ChainUp provides a complete suite of blockchain technology solutions, covering both infrastructure development and ecosystem support for businesses, it was built on a set of comprehensive security measures and processes to ensure system security, user information confidentiality, and privacy. The SOC 2 Type 1 certification reflects ChainUp’s commitment to technical and operational best practices in protecting the business, customer data and users’ digital assets. Presently, ChainUp is pursuing the completion of SOC 2 Type 2 audit to further demonstrate their commitment in protecting data and establishing total trust with businesses and users.

Sailor Zhong, Founder and CEO of ChainUp, said: “ChainUp has been committed to providing efficient, secure and reliable blockchain technology services to businesses and users worldwide. The completion of SOC2 Type 1 certification is an important milestone for us in validating the quality and security of our services. As a customer-first company, we anticipate the level of compliance businesses and institutional investors would expect and ChainUp remains dedicated to ensuring the utmost security and privacy protection for all business, customer and user information.”

About ChainUp

Founded in 2017 and headquartered in Singapore, ChainUp is a global leading end-to-end blockchain technology solutions provider covering infrastructure development and ecosystem support. We provide a complete suite of secure and compliant blockchain solutions including digital asset exchange, NFT trading, wallet, liquidity, Web3 infrastructure, merkle tree proof-of-reserves, digital asset custody, and more. ChainUp currently serves more than 1,000 customers across 30 countries, reaching more than 60 million end-users.

Find out more about ChainUp: www.chainup.com

Business

Magic Eden Partners With D3 To Apply For .magic Top-Level Domain

D3 Global, a next-generation domain name company developing the first on-chain domain network, today announced an exclusive partnership with Magic Eden, the leading cross-chain NFT platform, to apply for and obtain the .magic Top-Level Domain (TLD). This partnership will enable Magic Eden to seamlessly integrate with critical Internet infrastructure, which will streamline the onboarding of regular internet users, developers, and Web3 communities alike.

Once the .magic TLD is approved by ICANN, the organization that manages and maintains the Internet’s core infrastructure, the D3 network will allow for real .magic domains to be used across the traditional internet and Web3. Users will be able to utilize a single .magic domain as a website and email address, while also leveraging it for web3 applications such as wallets and verified credentials.

Fred Hsu, CEO and co-founder of D3, commented on the news: “While many communities have attempted to build their own web3 identifiers, these solutions don’t actually connect to the broader internet. Our partnership with Magic Eden is intended to marry the many benefits of Magic Eden’s web3 ecosystem with crucial connections to traditional internet users. We believe this is the only way to truly grow the web3 community – by onboarding billions of internet users and meeting them where they are.”

Through D3’s on-chain network, developers and blockchain projects will be able to create truly interoperable dApps, platforms, and services that not only enhance the utility of Web3 but also tap into existing internet infrastructure used by over five billion people worldwide.

“The Magic Eden community is at the heart of everything we do, and we are excited to provide users with their own .magic domain in partnership with D3,” said Chris Akhavan, Magic Eden Chief Revenue Officer. “Billions of Internet users use domains to access and navigate the web daily, and soon they will be able to do the same within the Magic Eden ecosystem, welcoming new users to experience the benefits of Web3 without sacrificing the Web2 functionality they’re accustomed to.”

D3 and Magic Eden will submit the application for the .magic TLD during ICANN’s upcoming application window. This is the first major new generic TLD application window since 2012, and only the second in ICANN history, presenting a unique opportunity for web3 communities to establish their domain presence. D3 Global supports leading companies across the web3 and blockchain industry and will announce additional partnerships in the near future.

About D3 Global

D3 Global is developing the first interoperable on-chain domain network that will deliver secure, decentralized, and interoperable identities on the root layer of the internet – the Domain Name System (DNS). D3’s patent-pending platform will be the first to deliver real domain names that seamlessly bridge the gap between traditional Internet infrastructure and Web3 ecosystems. D3 team consists of industry veterans with over three decades of collective experience, known for leading domain name monetization, internet protocols, and various TLD operations including .xyz, .inc, .tv, and .link.

Learn more about D3 at https://www.d3.inc

About Magic Eden

Magic Eden is the leading cross-chain platform shaping the future of Web3. Beyond its leading NFT marketplace, Magic Eden is a comprehensive, user-friendly ecosystem including a secure cross-chain wallet. Empowering users to mint, collect, and trade digital assets across blockchain networks, Magic Eden brings cultural moments onto the blockchain, fostering creativity and community engagement. Explore the future of digital ownership at magiceden.io.

Business

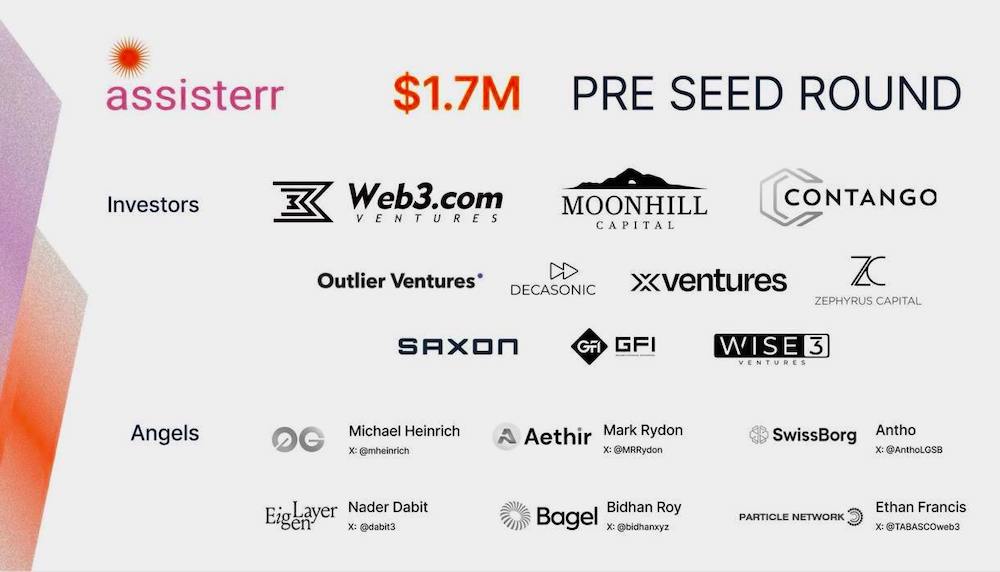

Web3 AI platform Assisterr raised $1.7M pre-seed round to enable community-owned AI

Assisterr, a Cambridge-based AI Infrastructure startup dedicated to revolutionizing artificial intelligence through community ownership and a network of small language models, has successfully closed a $1.7 million pre-seed funding round. The investment round saw participation from prominent Web3 venture funds including Web3.com Ventures, Moonhill capital, Contango, Outlier Ventures, Decasonic, Zephyrus Capital, Wise3 Ventures, Saxon, GFI Ventures, X Ventures, Koyamaki, Lucid Drakes Ventures, and notable angels, including Michael Heinrich, co-founder & CEO at 0g.ai, Mark Rydon, co-founder & CEO at Aethir, Nader Dabit, Director of Developer Relations at Eigen Labs, Anthony Lesoismier-Geniaux, co-founder at SwissBorg, Ethan Francis, Head of Developer Relationships at Particle Network and more committed to advancing decentralized AI solutions. The company aims to empower developers to build their own AI use cases using Assisterr’s infrastructure.

Assisterr is revolutionizing the AI landscape with its innovative approach to Small Language Models. Leveraging the Solana blockchain, Assisterr empowers communities to collaborate, aggregate, and monetize their data and expertise in specialized subjects. Small Language Models (SLMs) are tailored AI models optimized for efficient performance on edge devices focusing on specific domain tasks.

Since its launch, Assisterr has achieved major milestones, including attracting 150,000 registered users to its platform. Assisterr has also successfully launched more than 60 Small Language Models (SLMs) curated for leading Web3 protocols such as Solana, Optimism, 0g.ai, and NEAR. Additionally, the company has garnered recognition by winning multiple global hackathons, including the recent AI x Crypto event hosted by BeWater, OKX, and Binance Labs. Furthermore, Assisterr has been selected to participate in Google’s AI Startups program, securing $350,000 in funding that supports its GPU, CPU, and cloud infrastructure needs.

Nick Havryliak, CEO, and Co-founder at Assisterr shared the company’s vision: “At Assisterr, we are building an AI tokenization stack to ensure fair compensation for data owners and contributors. Our platform manages the entire lifecycle of SLM training, enabling features like data provenance tracking, fine-tuning, and the launch of SLM-powered Agents. Web3 component allows data-owners to contribute their data and expertise to domain-specific SLMs and capture the value from such contributions.”

Assisterr’s core technology stack

Small language models are neural networks trained on extensive text data sets. They are primarily designed to generate text resembling the patterns found in their training data. SLMs are smaller and more efficient than traditional Large Language Models (LLMs), capable of handling up to 8 billion parameters. Their deployment on edge devices including laptops and smartphones makes them ideal for applications where data privacy and efficiency are the need of the hour.

Assisterr’s core technology stack features several core components. The Data Provenance Protocol plays an important role in enabling decentralized coordination, ensuring the accuracy and reliability of domain-specific Small Language Models (SLMs). Their AI Lab incorporates intuitive no-code functionality, empowering users to seamlessly create, customize, and manage community-owned SLMs and SLM-powered Agents. Additionally, the SLM-Agent Marketplace serves as a platform for tackling distribution challenges by attracting early adopters and fostering growth within the AI ecosystem. These solutions support Assisterr’s commitment to advancing decentralized AI technologies while enhancing accessibility and innovation in AI model development and deployment.

With the influx of fresh funding, Assisterr will focus on several initiatives including protocol development and forming strategic partnerships to strengthen its infrastructure. The company also plans to drive ecosystem growth by launching an incentive program tailored for model builders and data contributors.

Additionally, Assisterr aims to enhance accessibility with the introduction of a no-code AI lab module, designed to attract a broader range of creative AI model builders to its platform. As Assisterr continues to expand, the platform’s primary objective is to enhance its infrastructure, broaden its support for additional use cases, and onboard the first million SLM-builders to the ecosystem.

About Assisterr.ai

A Cambridge-based startup building a Network of Community-Owned Small Language Models (SLMs). By leveraging the Data Provenance Protocol and providing an end-to-end infrastructure for launching and maintaining community-owned SLMs, Assisterr unlocks the value of aggregating human intelligence.

For more information, visit:

www.assisterr.com

https://x.com/assisterr

Business

Wirex and Visa Expand Partnership to Drive Web3 Payment Adoption

Wirex, the leading Web3 money app, and Visa, a world leader in digital payments, are thrilled to announce a partnership to further the use of digital currencies in the UK and the European Economic Area (EEA).

This collaboration will explore new opportunities to leverage and integrate innovative Visa cards and reduce friction in payment experiences. By combining the strengths of both companies, consumers will have the trust and confidence of Visa’s payment network with Wirex’s product innovation.

A major highlight of this partnership is the launch of Wirex Pay, the modular Zero Knowledge (ZK) payment chain incubated by Wirex. Wirex Pay is designed to revolutionise how users manage and spend both crypto and traditional currencies. This innovative product aims to simplify transactions, offering a seamless way to handle funds. It showcases fintech innovation by enabling seamless transactions between blockchain technology and traditional finance.

Wirex proudly stands as a crypto-native company holding Visa principal license capabilities for card issuance. Together, Visa and Wirex are committed to developing projects that integrate blockchain technology with traditional financial systems, ensuring smooth and efficient transactions. As such, Visa will support Wirex’s growth in existing markets through enhanced marketing efforts, leveraging Visa assets and capabilities.

Sviatoslav Garal, Global Head of Payments at Wirex, remarked, “Being among the few crypto-native companies licensed by Visa for card issuance, and notably the first principal member of Visa Network in Europe, emphasizes Wirex’s pioneering role in the financial industry. At a time when the financial world is boldly moving towards Web3 and decentralisation, the need for robust solutions for global funds movement remains essential. Key ecosystem players like Visa play a tremendous role in this shift. Wirex, a renowned innovator in both Web3 and traditional finance, is thrilled to partner with Visa in bridging the gap between these two spaces.”

“Partnering with Wirex to help integrate blockchain technology with traditional finance, including the launch of Wirex Pay, aligns closely with our vision for the future of payments while highlighting the importance of collaboration in driving fintech innovation,” said Cuy Sheffield, Head of Crypto at Visa.

About Wirex

Wirex is a prominent UK-based digital payments platform with over 6 million customers spread across 130 countries. It offers secure accounts, making it easy for users to store, purchase, and exchange multiple currencies seamlessly.

As a principal member of both Visa and Mastercard, Wirex goes beyond traditional services, embracing the evolving trends of Web3 to provide mainstream access to digital finance and wealth management.

Having processed transactions totalling $20 billion, Wirex aims to contribute to the adoption of a cashless society by facilitating straightforward transactions in various currencies worldwide. Wirex is simplifying digital payments, making it more accessible and convenient for people across the globe.

Business

BloFin Exchange enhances compliance and security with Chainalysis

BloFin Exchange, a leading cryptocurrency trading platform renowned for its robust security measures and user-centric innovations, is excited to announce its integration with the Chainalysis blockchain data platform. This development is pivotal in enhancing the exchange’s compliance capabilities and safeguarding the assets of its global user base. Currently, BloFin offers up to 320 contract trading pairs and 100 spot trading services, achieving a hundredfold growth compared to 2023.

As part of its commitment to providing a safe and compliant trading environment, BloFin is implementing the Chainalysis crypto risk solution, enabling BloFin to monitor cryptocurrency transactions in real time, ensuring compliance with regulatory requirements and combating financial crime.

“We are thrilled about our collaboration with Chainalysis, which significantly enhances our platform’s security and compliance. In the crypto field, blockchain analytics is one of the most effective tools to prevent money laundering, and Chainalysis’ blockchain data platform is trusted by governments across the globe. At BloFin, we have always prioritized the security of our users’ assets. Our decision to collaborate with Chainalysis early in our development demonstrates our commitment to anti-money laundering. Integrating the Chainalysis crypto risk solution reinforces our commitment to these priorities. We are confident this collaboration will strengthen our ability to protect our community and set new standards for safety and trust in the cryptocurrency space. – Matt, BloFin CEO.”

BloFin has consistently been at the forefront of the crypto market due to its pioneering approach to product features and user experience. With a user-friendly interface and a suite of innovative trading tools, BloFin caters to the needs of both novice and experienced traders. Utilizing Chainalysis crypto risk solution further underscores BloFin’s dedication to regulatory compliance and operational transparency.

This integration aligns with BloFin’s strategic vision to utilize cutting-edge technologies that enhance user trust and security. By leveraging Chainalysis’ comprehensive blockchain analysis tools, BloFin can more efficiently identify potentially risky transactions, thereby protecting its community and contributing to the overall safety of the cryptocurrency ecosystem.

For more information about BloFin Exchange and its services, please visit https://blofin.com/.

About BloFin Exchange

BloFin is a global cryptocurrency exchange that offers a secure platform for trading various digital assets. The fastest-growing crypto exchange offers premium perpetual and futures trading services with over 320 USDT-M trading pairs, covering Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and various altcoins, along with up to 150X leverage. Seamlessly transition between our mobile app and web platform for uninterrupted trading, even on the go.

BloFin official website: https://www.blofin.com

Join BloFin’s account: https://www.blofin.com/register

BloFin Twitter: https://x.com/Blofin_Official

About Chainalysis

Chainalysis is a blockchain data platform. We provide data, software, services, and research to government agencies, exchanges, financial institutions, and insurance and cybersecurity companies in over 70 countries. Our data powers investigation, compliance, and market intelligence software that has been used to solve some of the world’s most high-profile criminal cases and grow consumer access to cryptocurrency safely. Backed by Accel, Addition, Benchmark, Coatue, GIC, Paradigm, Ribbit, and other leading firms in venture capital, Chainalysis builds trust in blockchains to promote more financial freedom with less risk. For more information, visit www.chainalysis.com.

Business

PlayFi Announces Strategic Alliances & Integrations with Four Industry Leaders to Enhance Gaming Innovation Through AI and Web3

PlayFi, an AI-powered data network and blockchain tailored for the gaming industry, has announced new engagements with four industry leaders aimed at strengething the gaming ecosystem through enhanced technology integrations. PlayFi, which sits at the intersection of gaming, web3, and AI, will be working alongside Aethir, MultiversX, Squid, and Matter Labs, furthering PlayFi’s commitment to advancing the gaming industry with cutting-edge blockchain solutions.

“We are thrilled to be working with industry leaders like Aethir, MultiversX, Squid, and MatterLabs, on a shared mission to push the boundaries of what’s possible in gaming,” said Ben Beath, founder and CEO of PlayFi. “Together, we share a goal in creating a more interconnected, efficient, and immersive gaming ecosystem that will benefit developers and players alike. We are grateful for the work we’ve already done as partners and look forward to the milestones we will achieve together.”

The goal throughout all of these engagements allows PlayFi to enhance its web3 offerings across verticals by integrating advanced blockchain technology into the gaming ecosystem, enhancing cross-chain interactions, improving data security and accessibility, and providing seamless, cost-efficient experiences for developers and gamers. This will be achieved by:

- Aethir’s GPU resources: As part of a shared commitment to optimizing GPU cloud computing resource use and enhancing technological capabilities across gaming and AI, PlayFi and Aethir are joining forces to harness this technological expertise and bring mass-market gaming to the blockchain, fostering approaches that support a robust gaming ecosystem and enable developers to build seamless Web3 experiences on top of Web2 IP. Aethir’s expertise in redistributing GPU resources by leveraging decentralized cloud infrastructure is vital to PlayFi, as it aims to enhance the gaming ecosystem and provide gamers worldwide with unparalleled experiences. In addition, PlayFi is also providing all Aethir Checker Node holders guaranteed whitelist access to PlayFi’s upcoming node license sale, ensuring they secure the best prices. More information on this integration can be found here.

- MultiversX’s secure data storage: Through collaboration with MultiversX, PlayFi will enable the MultiversX ecosystem to leverage the PlayBase network – the AI-driven core of the PlayFi ecosystem – to securely store data from blockchain-powered games and sovereign chains. PlayFi will work with MultiversX on the development of specialized oracles compatible with the MultiversX infrastructure, offering seamless access to PlayBase’s rich data, thus unlocking new possibilities and enriching gaming experiences.

- Squid’s SDK integration: PlayFi and Squid have joined forces to boost interactivity and accessibility within the PlayFi ecosystem. Together, this enables seamless token swaps across different blockchains. With Squid’s innovative API and SDK integration, PlayFi users can effortlessly swap any token type, connecting diverse blockchain environments such as Ethereum, zkSync, and Polygon. Thanks to this integration, in-game items, rewards, and other digital assets can now be won in one game and redeemed in another. This integration aims to set new standards in gaming by reducing costs, improving efficiency, and broadening market reach, ultimately expanding gaming possibilities and scaling user experiences at increased ease.

- Matter Labs’ ZK Stack: Matter Labs’ ZK Stack is the powerful Layer-2 solution powering PlayFi’s PlayBase blockchain. By incorporating ZK Stack, PlayFi benefits from ultra-low gas fees, combining the efficiencies of ZK Rollups and Validiums, which significantly reduces costs while boosting transaction throughput. This integration also introduces native account abstraction, making PlayFi accessible to a broader audience by allowing transactions without a crypto wallet. With faster finality times, seamless connectivity, and liquidity access within the ZK Stack network, including zkSync, this integration ensures PlayFi remains at the forefront of blockchain infrastructure, providing a fast, affordable, and interconnected gaming experience.

“PlayFi unites AI and gaming, the two key sectors in which Aethir is engaged as a decentralized cloud computing provider. Through our collaboration with PlayFi, we are supporting cutting-edge innovations that leverage the power of AI to enhance Web3 gaming and introduce new, groundbreaking experiences for builders and players alike. Aethir’s DePIN stack is a reliable and highly-scalable ally of AI and gaming platforms, so teaming up with an industry innovator like PlayFi was a natural step for us,” said Daniel Wang, CEO of Aethir.

The PlayFi team is led by a 6x startup founder alongside builders who have impressive experience at Activision Blizzard, BumbleBear Games (developer of popular arcade game Killer Queen), Meta, BattleFly Game, and more.

About PlayFi

PlayFi is redefining gaming by integrating blockchain technology to enhance gameplay and community engagement. Through its cutting-edge PlayChain technology and AI-powered PlayBase network, PlayFi ensures a fast, secure, and scalable zkEVM blockchain solution, as well as optimal data processing and analysis tailored for the gaming industry. With a commitment to enhancing the gaming experience with web3, PlayFi is empowering developers, players, and studios across the globe to push the boundaries of innovation in an ever-evolving digital landscape and setting new standards in how games are played, developed, and monetized. For more information, users can visit playfi.ai.

Business

CyberConnect Rebrands To Cyber And Releases the First L2 for Social on Mainnet

In partnership with AltLayer, Optimism, and EigenLayer, Cyber, the first L2 for social, has been launched on Mainnet!

Cyber leverages leading modular solutions, such as Optimism’s OP Stack and customized infrastructure secured by EigenLayer’s Actively Validated Services (AVS). To meet the unique needs of social applications, Cyber expands on these by integrating purpose-built tools developed by the team. To mark this significant launch, CyberConnect has rebranded to Cyber with a revamped VI and spun out Link3 to focus on its L2 and developer-centric offerings.

H2: Cyber, Previously Known As CyberConnect, Unveils The First L2 For Social

Cyber, formerly CyberConnect, has announced the launch of its L2 on Mainnet and its rebranded identity. This consolidates all the developer-centric solutions and infrastructure offerings released by the team under a single brand, centered around its new Layer 2 for social applications. Cyber aims to simplify application development through an all-in-one platform that integrates high-performance infrastructure and purpose-built tools.

Over the last few years, the team behind Cyber has introduced several products, including the CyberConnect Protocol, CyberWallet, and Link3, which have shaped the web3 social landscape. With a refined focus on their L2, Cyber is spinning out Link3 as a standalone brand. Rebranded Cyber comes with a fully revamped visual identity that’s young, bold, and adaptive, signifying the value social can bring to a diversity of use-cases. To celebrate the launch of Cyber and its rebrand, a commemorative NFT mint is being held.

H3: High-Performance Infrastructure With Purpose-Built Features For Social

Deployed by AltLayer using Optimism’s OP Stack, Cyber joins the Superchain alongside several OP stack L2s including Base and Mode. By doing so, it adopts a shared vision and pledges to contribute a portion of the revenue generated by its sequencer back to the Optimism Collective.

Cyber aims to facilitate the creation of social applications that offer a familiar web2-like experience, enriched with web3 benefits. Through native Account Abstraction and familiar authentication methods such as Passkey and Webauthn, Cyber enables FaceID wallet access for users. Cyber also natively supports Smart Accounts, allowing for gas sponsorship, which is crucial for user adoption.

For developers, Cyber incorporates features built by the team into its L2 to meet the specific needs of social applications. Cyber’s unique infrastructure features include its enshrined CyberConnect Protocol and CyberDB. These enable developers to interact with and store social data securely and efficiently.

During the next month, Cyber is focused on attracting projects and applications for users to engage and play in their upcoming Social Summer Campaign. To support ecosystem growth, Cyber has set aside $2M for grants to builders. It has already distributed $170k in $CYBER tokens during the pilot phase of their Ecosystem Grants program. Several additional grant rounds will come, so developers actively building or considering building innovative social apps and infrastructure are encouraged to join the ecosystem. Developers interested in building on Cyber can visit its Developer Documentation.

About Cyber

Cyber, the L2 for social, enables developers to create apps that transform how people connect, create, monetize, and share the value they generate.

By simplifying workflows and accelerating time to market, Cyber streamlines development through an all-in-one platform that integrates high-performance infrastructure—with ultra-low fees and high TPS—and purpose-built tools for social applications, such as the CyberConnect protocol and CyberDB. To meet the demand for a seamless UX in social applications, Cyber offers a familiar, web2-like experience enriched with web3 benefits, through features like native Account Abstraction and seedless wallets.

With 3 years of experience in building decentralized social networks, Cyber leverages its resources and knowledge to nurture a synergistic ecosystem with strong support systems atop its L2.

Business

STON.fi, Leading DEX in TON Ecosystem, Secures Funding from CoinFund

Today, STON.fi, a leading decentralized automated market maker exchange (AMM DEX) built on the TON blockchain, announces a previously undisclosed round led by CoinFund with participation from Delphi Ventures, Karatage and TON Ventures, as well as Sergej Kunz and Anton Bukov, Co-Founders at 1inch, and Philipp Zentner, CEO of LI.FI. The funding will be used to fuel operations for STON.fi’s rapid growth, on a mission to expand DeFi services to Telegram users via instant exchange of Toncoin and USD stablecoins for any native token at the best rate.

STON.fi provides a decentralized cross-blockchain platform that allows users to effortlessly trade their crypto assets across multiple blockchains without the need for bridging or wrapping. Integrating seamlessly with the rapidly growing Telegram Messenger and its 900 million monthly active users (MAUs), STON.fi offers a user-friendly and accessible solution that empowers individuals to manage their digital assets while maintaining full control.

“STON.fi exists to make it simple and fair for everyone to access DeFi as easily as they use Telegram,” said Slavik Baranov, CEO of STON.fi. “STON.fi is building a cross-blockchain decentralized platform that provides a reliable and secure way to trade cryptocurrencies without relying on centralized institutions.”

The innovative and distinguishing aspect of STON.fi is the OMNISTON protocol, which allows the implementation of direct cross-chain swaps and eliminates the need for intermediaries or third parties. This approach minimizes user risk associated with security breaches and significantly enhances the transaction speed. Since the beginning of 2024, STON.fi’s liquidity measured by total value locked (“TVL”) has increased 26x and its MAUs 49x. Today, STON.fi is #1 in the two most important DeFi categories, TON native TVL with greater than $115M and spot volume of roughly $676M in April.

“STON.fi is the liquidity layer underpinning the consumer crypto activity on TON,” said Einar Braathen, Partner at CoinFund. “The seamless integration into Telegram Messenger opens up native possibilities for simple peer-to-peer transfers of digital assets, serving users where they are, and eliminating the need for intermediaries. STON.fi is poised to capture the real momentum driven by the cultural moment that Telegram is having right now.”

As Telegram has developed a global user base, its users have demonstrated they have real need for an app ecosystem underpinned by blockchain. STON.fi is a key building block for applications and mini-apps on Telegram enabling developers to easily integrate TON DeFi through the STON.fi SDK.

About STON.fi

STON.fi is the leading decentralized exchange (DEX) on the TON blockchain, characterized by its dominance in the number of available tokens, total value locked (TVL), trading volume and users. It is designed for seamless integration with TON wallets, enabling trading of any TON-based token. In addition, STON.fi offers advanced functionalities including farming and staking. The platform has also announced the development of innovative ‘OMNISTON’ protocol, which will allow cross-chain swaps, facilitating exchanging between different blockchains without the need for bridging or wrapping.

About CoinFund

CoinFund is one of the world’s first cryptonative investment firms and a registered investment adviser founded in 2015. The firm champions the leaders of the new internet, powered by foresight as active investors to achieve extraordinary outcomes. CoinFund invests in seed, venture, and liquid opportunities within the blockchain sector with a focus on digital assets, decentralization technologies, and key enabling infrastructure.

Business

XREX Singapore Receives MAS Major Payment Institution Licence

XREX Singapore, a blockchain-enabled financial institution specialising in cross-border payments in emerging markets, announced today that it has obtained the Major Payment Institution (MPI) Licence from the Monetary Authority of Singapore (MAS), the nation’s central bank and financial regulator. This comes after it received its in-principle approval from the MAS in November last year.

Commenting on XREX’s engagement with the MAS, XREX Singapore Chief Executive Officer (CEO) Christopher Chye said, “Our engagements with the MAS have repeatedly shown us why they are internationally revered as a leading central bank and financial regulator. With this licence in hand, XREX Singapore will endeavour to bring blockchain-enabled digital payment currencies to ubiquity.”

XREX Singapore facilitates frictionless cross-border payments for import and export transactions, particularly for small-medium businesses (SMBs) in emerging markets. This strategic emphasis aligns with XREX’s mission to foster financial inclusion in emerging markets.

“The MPI licence is a testament to our unwavering commitment to the highest regulatory compliance standards. We look forward to working with one of the world’s leading regulators to make blockchain finance safe and accessible to the general public,” said XREX Co-founder and Group CEO Wayne Huang.

XREX Singapore will launch XREX Pay, a platform providing cross-border B2B payment features for corporates, as well as remittance solutions, such as helping migrant workers send money home. XREX Pay will support Singapore Dollar (SGD) and U.S. Dollar (USD) payment rails and stablecoins such as USDT and USDC, all while demonstrating a robust and practical implementation of the Financial Action Task Force (FATF) travel rule.

XREX Singapore’s licence encompasses a total of six payment services, namely:

i) Account issuance service;

ii) Domestic money transfer service;

iii) Cross-border money transfer service;

iv) Merchant acquisition service;

v) E-money issuance service; and

vi) Digital payment token service.

“XREX is approved for six of the seven payment services under the MPI licencing regime. With XREX Singapore as the group’s Asia Pacific headquarters, XREX looks forward to expanding its partnership with major banks, credit card institutions, and payment institutions to build next-generation financial systems that integrate traditional and blockchain finance,” said XREX Co-founder and Group Chief Revenue Officer Winston Hsiao.

About XREX

XREX Singapore is an MAS-regulated financial institution that leverages blockchain technology to make cross-border payments faster, cheaper, and safer for businesses globally. Its proprietary escrow payment feature, BitCheck, empowers enterprises to switch flexibly between digital currencies, stablecoins, or traditional currencies, thereby ushering their businesses into the new era of digital money. XREX Singapore also specializes in working with emerging markets businesses to help solve their issues with USD liquidity access.

XREX Group, is a blockchain-enabled financial institution working with banks, regulators, and users to redefine banking together. It provides enterprise-grade banking services to small to medium-sized businesses (SMBs) in or dealing with emerging markets, and novice-friendly financial services to individuals worldwide.

Founded in 2018 and operating globally under multiple licences, XREX offers a full suite of services such as digital asset custody, wallet, cross-border payment, fiat-crypto conversion, cryptocurrency exchange, asset management, and fiat currency on-off ramps.

Sharing the social responsibility of financial inclusion, XREX leverages blockchain technologies to further financial participation, access, and education.

Business

JanOne to Acquire ALT 5 Sigma Inc., a Leading Next Generation Blockchain Financial Technology Provider

JanOne Inc. announced today that it has executed a Definitive Agreement to acquire blockchain financial technology provider, ALT 5 Sigma Inc., a Delaware corporation, and each of its wholly-owned subsidiaries. The transaction is anticipated to close the week of May 13th, 2024 and is subject to customary closing conditions and regulatory requirements as applicable.

Launched in 2018, ALT 5 is a fintech that provides next generation blockchain-powered technologies to enable a migration to a new global financial paradigm. ALT 5, through its subsidiaries, offers two main platforms to its customers: “ALT 5 Pay” and “ALT 5 Prime.”

ALT 5 Pay is a crypto-currency payment gateway that enables registered and approved global merchants to accept and make crypto-currency payments or to integrate the ALT 5 Pay payment platform into their application or operations using the plugin with WooCommerce and or ALT 5 Pay’s checkout widgets and APIs. Merchants have the option to convert to fiat currency (US Dollars, Canadian Dollars, Euros, and British Pounds Sterling) automatically or to receive their payment in digital assets.

ALT 5 Prime is an electronic over-the-counter trading platform, that enables registered and approved customers to buy and sell digital assets. Customers can purchase digital assets with fiat and, equally, can sell digital assets and receive fiat. ALT 5 Prime is available through a browser-based access, mobile phone application named “ALT 5 Pro” that can be downloaded from the Apple App Store, from Google Play, through ALT 5 Prime’s FIX API, as well as through Broadridge Financial Solutions’ NYFIX gateway for approved customers.

According to Research and Markets.com “The Payment Processing Solutions Market size is estimated to grow from approximately USD 100 Billion in 2023 at a CAGR of 9.5% during the forecast period from 2023 to 2030.” In addition the report states, “Technological advancements, including artificial intelligence, machine learning, and blockchain, are revolutionizing the payment processing landscape.”

Source https://ca.finance.yahoo.com/news/global-payment-processing-solutions-market-121800862.html

“We believe that ALT 5’s innovative solutions provide significant competitive advantages in this market and together we can help them continue their growth,” said Tony Isaac, President and CEO of JanOne Inc. “The innovative products and services delivered by ALT 5 to its global customers are at the forefront of the payment processing industry and have contributed to reducing risk and eliminating costly credit card charge-backs. In addition, ALT 5 has developed a profitable business that we can assist to rapidly scale globally. With ALt5 as the foundation, we will begin working with the Alt5 team to identify additional opportunities for expansion of the product portfolio, and the scale of the business.”

Mr. Andre Beauchesne, President of ALT 5 Sigma Inc., stated, “Since our beginning in 2018, it has been one of our objectives to be a part of publicly traded company and being acquired by JanOne starts a bright new chapter in our growth story.” He added, “As we continue to build on our strong foundation, JanOne’s management team and public listing will help leverage many opportunities.”

Overview of the transaction

At closing, JanOne will issue to the former stockholders of ALT 5 1,799,100 shares of its common stock, which represents approximately 19.9% of JanOne’s will issue to the outstanding common stock as of May 10, and (ii) 34,207 shares of its Series B non-convertible, non-redeemable preferred stock. At closing ALT 5 Sigma Inc. and its subsidiaries shall become wholly owned subsidiaries of JanOne.

Additional details about the acquisition can be found on JanOne’s website at https://ir.janone.com/sec-filings or in JanOne’s filings with the Securities and Exchange Commission at https://www.sec.gov/edgar/browse/?CIK=862861&owner=exclude.

About JanOne Inc.

JanOne is a unique Nasdaq-listed company offering innovative, actionable solutions intended to help end the opioid crisis. JanOne is dedicated to funding resources toward innovation, technology, and education to find a key resolution to the national opioid epidemic, which is one of the deadliest and most widespread in the nation’s history. Its drugs in the clinical trial pipeline have shown promise for their innovative targeting of the causes of pain as a strategic option for physicians averse to exposing patients to addictive opioids.

Please visit www.janone.com for additional information.

Business

XVC Tech Announces Strategic Investment in TradeTogether to Enhance Web3 Wealth Management

XVC Tech, has invested in TradeTogether, a leading Web3 wealth manager based in Singapore. The venture capital firm founded by the creators of the XDC Network blockchain.

XDC Network’s ecosystem includes RWA dApps focusing on Private Credit (TradeFinex), Trade Finance (XDC Trade Network), tokenized gold (Comtech Gold) and tokenized US Treasuries (Yieldteq powered by Tradeteq).

Ritesh Kakkad, co-founder of XVC Tech, noted, “TradeTogether approached XVC with a strong emphasis on compliance, which is key in sectors like private credit and trade finance. We believe this focus on compliance will attract more institutional adoption, leading to increased utilization of the XDC Network’s use cases.”

Added TradeTogether’s CEO Geoff Ira, “XDC Network is a robust Enterprise-grade Layer 1 blockchain with a strong focus on Real-World Assets (RWA). We eagerly anticipate collaborating with XDC and its ecosystem of dApps to develop top-tier Web3-centric funds, driving intelligent capital into RWAs and Web3, while adhering to regulatory compliance standards.”

TradeTogether introduces two innovative investment options

- Firstly, the TradeTogether Bitcoin Advantage Fund, allows clients to invest in Bitcoin with added protection against market downturns, offering a better experience than traditional ETFs.

- Additionally, TradeTogether provides high-net-worth individuals and financial institutions with transparent solutions in tokenized bonds and Web3 products for receivable financing, moving away from the DeFi platform model.

TradeTogether has prominent co-investors such as Orbit Startups, Tenity, Boleh Ventures and Leo Ventures. Other Angel investors who participated in TradeTogether’s funding round since it’s inception includes Samuel Rhee (Chairman of Endowus), Varun Mittal (Group Head Innovation Singlife), Reuben Lai (Former Senior MD Grab Financial Group), Mx Kuok (KUOK Family), E. BABA de Rothschild (EGR Partners), Chandrima Das (Ex bento founder acquired by Grab), Nicolas Gallet (Gallet Capital), David Bachelier (CEO Asia at Flowdesk).

About XVC Tech

Founded by the co-founders of XDC Network, Atul Khekade and Ritesh Kakkad, XVC Tech is a US $125mn Fund focussed on exploring investment opportunities in NextGen Technology Solutions. Portfolio companies include DeGaming, a decentralized i-gaming infrastructure protocol, Bolero, a platform fractionalizing IP of music assets via smart contracts or Truflation, an oracle for RWA, indexes and inflation.

Current areas of focus include RWA, Web3 infrastructure, AI, and DePIN. For Web3 startups looking to make an impact, new investment opportunities are actively being sought. Users interested in learning more can visit XVC Tech at XVC.Tech to get in touch.

About XDC Network

The XDC Network is an open-source, carbon-neutral, enterprise-grade, EVM-compatible, Layer 1 blockchain, operational since 2019 focusing on Enterprise use cases such as Trade Finance, Payment and RWA tokenization. More details at: Xinfin.org

About TradeTogether

TradeTogether Pte Ltd is a pioneering Web3 digital asset management company based in Singapore. Operating under a regulatory exemption since October 25, 2021, TradeTogether is at the forefront of innovative financial solutions in the digital asset space. Led by CEO Geoff Ira, who has a strong background in the financial and banking industry. For more information, users can visit TradeTogether.com

-

Blockchain3 weeks ago

Blockchain3 weeks agoHinkal announces ‘EigenLayer for Privacy’ with the upcoming launch of the Shared Privacy Protocol

-

News3 weeks ago

News3 weeks agoCwallet Expands Crypto Loans Landscape | Marking a New Era of Success in Lending

-

Altcoins2 weeks ago

Altcoins2 weeks agoNOWPayments expands crypto payment options with LayerZero ($ZRO) and ZK Token ($ZK)

-

Technologies2 weeks ago

Technologies2 weeks agoDiscover the Future of Trading with AXL Finance

-

News2 weeks ago

News2 weeks agoAibit Launch Garners Industry Attention, Poised to Become a Rising Star

-

Altcoins2 weeks ago

Altcoins2 weeks agoThe Covalent Network Successfully Migrates to New CXT Token to Drive Deeper Innovation in AI Following Governance Vote

-

Business2 weeks ago

Business2 weeks agoWirex and Visa Expand Partnership to Drive Web3 Payment Adoption

-

Blockchain1 week ago

Blockchain1 week agoData Ownership Protocol – Itheum – Launches on Solana, Embracing AI and Gaming