News

Bitmex: Ethereum Holdings in the ICO Treasury Accounts

Following on from our first piece on ICOs in September 2017, which focused on the team members and advisors, in this report we work with TokenAnalyst to track the Ethereum balances of the ICO projects over time. We look at the amount of Ethereum raised and the US$ value of the gains and losses caused by changes in the Ethereum price, for each project. We conclude that rather than suffering because of the recent fall in the value of Ethereum, at the macro level, the projects appear to have already sold almost as much Ethereum as they raised (in US$ terms). Of the Ethereum still held by the projects, even at the current c$230 price, projects are still sitting on unrealised gains, rather than losses.

Ethereum raised by 222 ICOs – Macro analysis

| ETH | US$m | |

| ETH raised by EOS | 7,211,776 | 3,824 |

| ETH raised by other projects | 7,972,003 | 1,639 |

| Total ETH raised | 15,183,779 | 5,463 |

| ETH sold by EOS | (7,211,776) | (3,892) |

| ETH transferred out/sold by other projects | (4,113,345) | (1,560) |

| Total ETH transferred out/sold | (11,325,121) | (5,452) |

| ETH Balance remaining (Sept 2018) | 3,858,659 | 830 |

(Source: Ethereum Blockchain, BitMEX Research, TokenAnalyst, Token Data, Price data from Etherscan)

Overall profits & losses caused by changes in the price of Ethereum – US$ million

| Realised gains | |

| EOS project gains | 68 |

| Gross realised ETH gains by other projects | 692 |

| Gross realised ETH losses by other projects | (34) |

| Net realised gains | 727 |

| Unrealised gains | |

| EOS unrealised gains | n/a |

| Gross unrealised ETH gains | 403 |

| Gross unrealised ETH losses | (311) |

| Net unrealised gains | 93 |

| Total net gains | 819 |

(Source: Ethereum Blockchain, BitMEX Research, TokenAnalyst, Token Data, Price data from Etherscan)

Notes:

- This analysis only considers the Ethereum balances of the ICO projects, which we have tracked on the Ethereum blockchain. Funds raised in currencies other than Ethereum are not considered nor is the balance of the new token created by the project. Our reported totals are therefore lower than some other sources. Therefore while our figures may be an underestimate, one at least has a degree of assurance that the balance is calculated independently of the project. At the same time we are missing several projects such as Tron, as we have not identified a treasury address or an address cluster.

- The estimate of the value of Ethereum raised is calculated by taking the highest value of Ethereum inside the address cluster of each project at any point in time (with the exception of EOS). This will result in some inaccuracies.

- The estimate of the value of US$ raised is calculated by using the average ETH price during the ICO period. This should therefore be considered as a rough and unreliable estimate.

- The estimate for the realised gains was calculated by taking the month end Ethereum balance for the address cluster of each project every month and then looking at the reduction in the Ethereum holdings. The average Ethereum price for each month was then used to estimate the US$ value of Ethereum that was sold. This is likely to be inaccurate and it is possible the project retains ownership of the Ethereum or that the Ethereum was not sold for US$.

- While we believe our estimates at the macro level may be reliable, at the individual project level our figures are likely to be unreliable. We apologise for any errors or inappropriate assumptions.

Commentary on the overall Ethereum holdings and sales

The Ethereum price has fallen almost 85% from the US$1,400 peak price in December 2017. As we mentioned back then, the value of Ethereum and the associated crypto-currencies was high and there was significant downside risk. The large fall in the value of Ethereum led some to question if there could be a “downward price spiral” due to the concentrated Ethereum holdings of the ICO projects. The theory being that many ICO projects were sitting on a large treasure trove of Ethereum and that as the price of Ethereum fell, these projects were going to “panic sell’, fearful of being the last project holding their Ethereum bags.

Our analysis, along with the team from TokenAnalyst, shows that on a macro level, the above theory may not be applicable. Of the 222 projects which we looked at, they raised US$5.5 billion worth of Ethereum and they may have already sold almost exactly the same amount (just US$11 million less). These ICOs currently hold 3.8 million Ethereum, around 25% of the Ethereum they originally raised. However, in US$ terms, these projects have essentially already sold the same amount of Ethereum which they originally raised, leaving them a nice holding of US$830m of Ethereum.

The figures are somewhat skewed by the EOS project, which remarkably raised around 70% of the Ethereum (by US$ value) of all the projects on our list, if our estimates are correct. However, even excluding EOS, the overall picture remains similar to what we described above, with projects selling almost the same in US$ terms as the amount they originally raised.

Despite the 85% reduction in the Ethereum price from its peak, the projects have realised gains of US$727 million due to profits from Ethereum have they already sold, often selling before the recent price crash. The 3.8m Ethereum still on the balance sheets of these projects may not have that much of an impact on the Ethereum price, as it represents a reasonably small proportion of the 102 million supply of Ethereum. At the same time, on a macro level, the projects may be feeling reasonably confident rather than needing to panic sell.

As for the unrealised profit and loss situation, the ICOs are sitting on net gains of US$93 million based on an Ethereum price of US$215. It may surprise some that ICOs are still in a net unrealised profit situation, but many of the Ethereum balances were built up before the price rally at the end of 2017, as the chart below indicates. Although some individual projects may be suffering significant losses. Gross unrealised losses, the sum of all the losses for the projects which have lost money by holding Ethereum, are US$311 million, which is more than offset by US$403 million in gross unrealised gains.

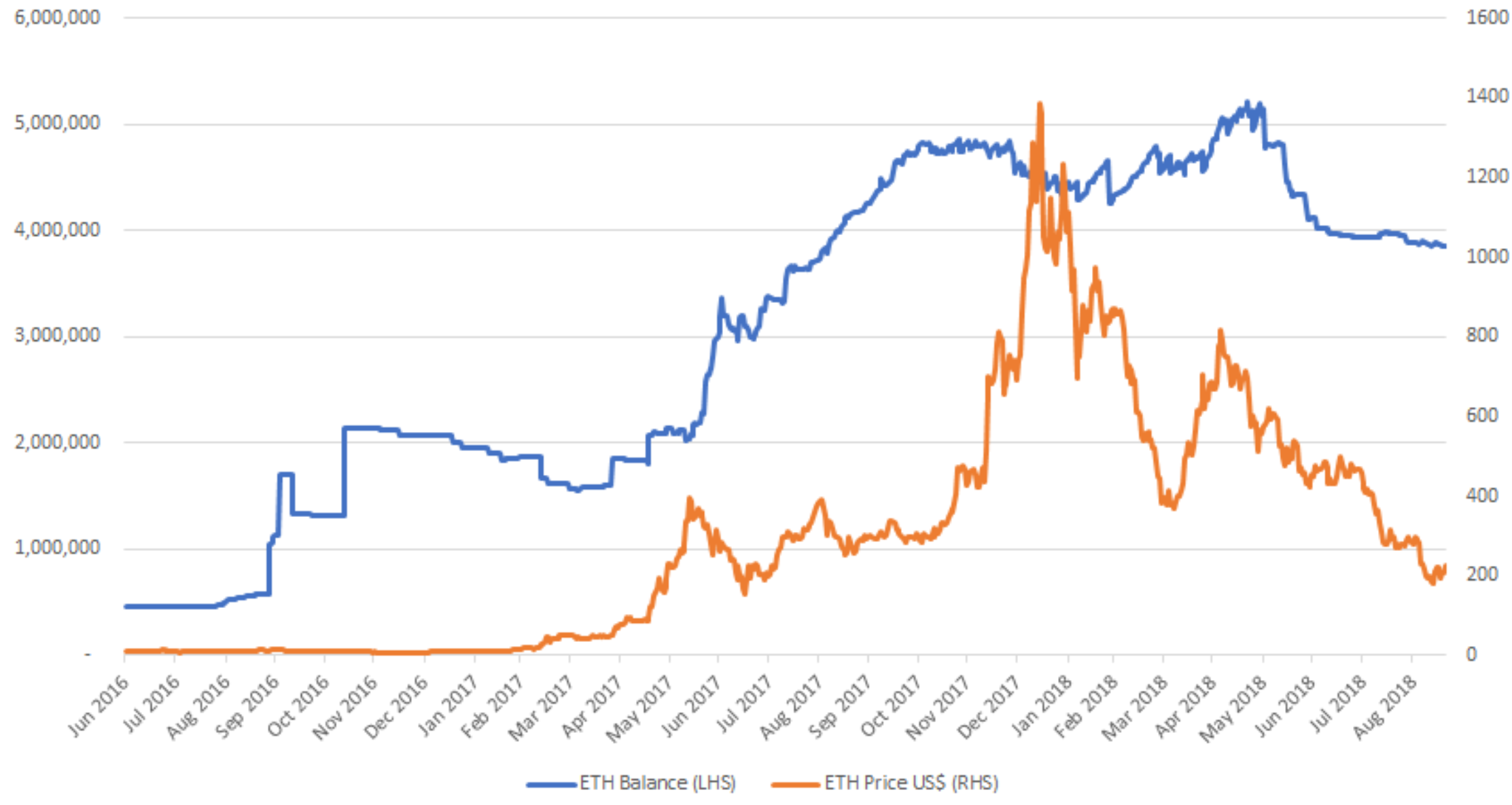

Total tracked Ethereum holdings of the 222 ICO projects (daily data) vs Ethereum price

(Source: Ethereum Blockchain, BitMEX Research, TokenAnalyst, Token Data, Price data from Etherscan)

As the above chart indicates, over the 26 month period, the peak Ethereum holdings of the ICO treasury accounts were only 5.1 million, significantly lower than the 15.2 million which was raised (8.0 million raised when excluding EOS). This may indicate that Ethereum proceeds from earlier ICOs were reinvested in new projects, either directly or more likely indirectly, after being sold on the market.

Breakdown of Ethereum holdings data by ICO project

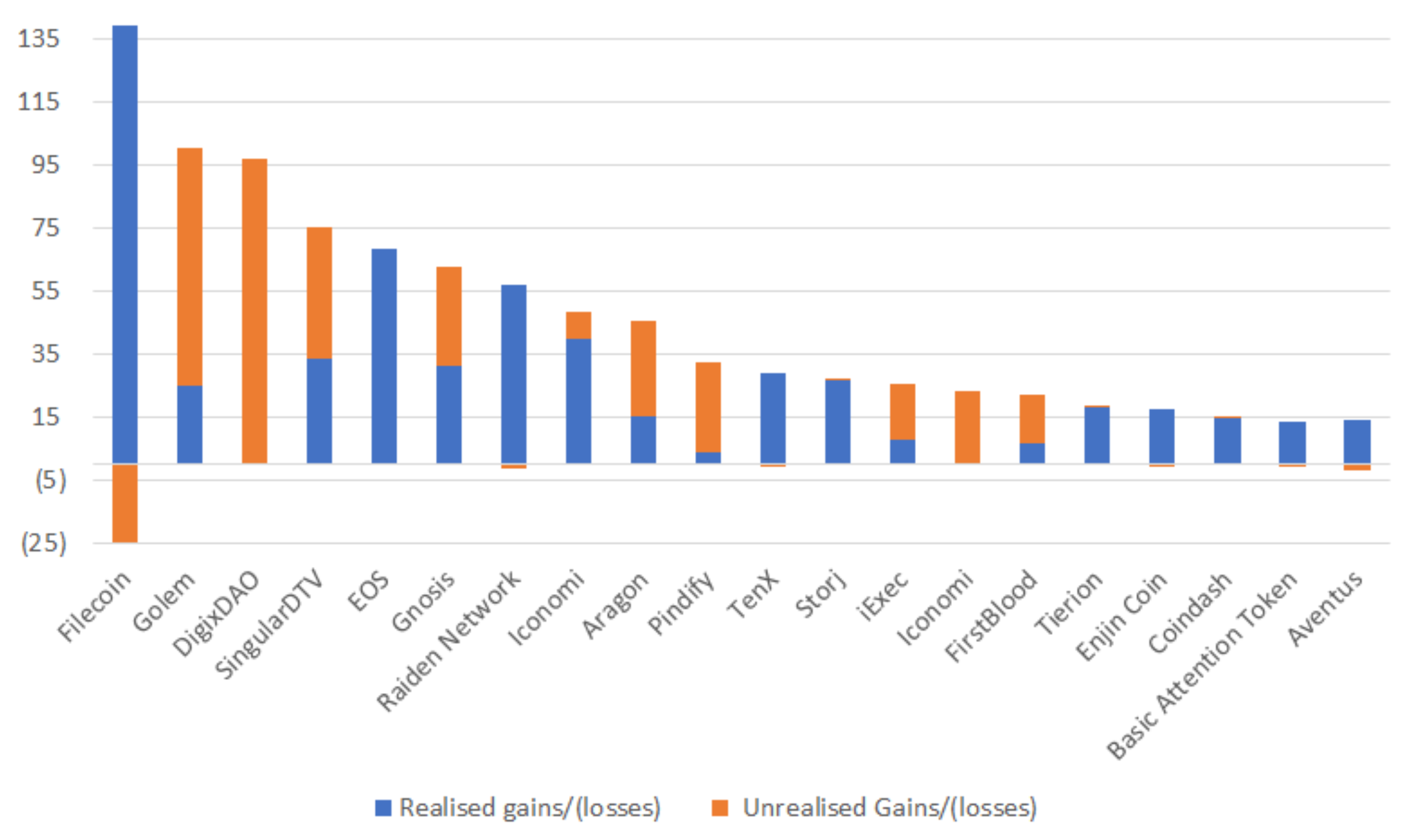

Top 20 ICO projects ranked by total gains from change in value of Ethereum holdings – US$ million

(Source: Ethereum Blockchain, BitMEX Research, TokenAnalyst, Token Data, Price data from Etherscan)

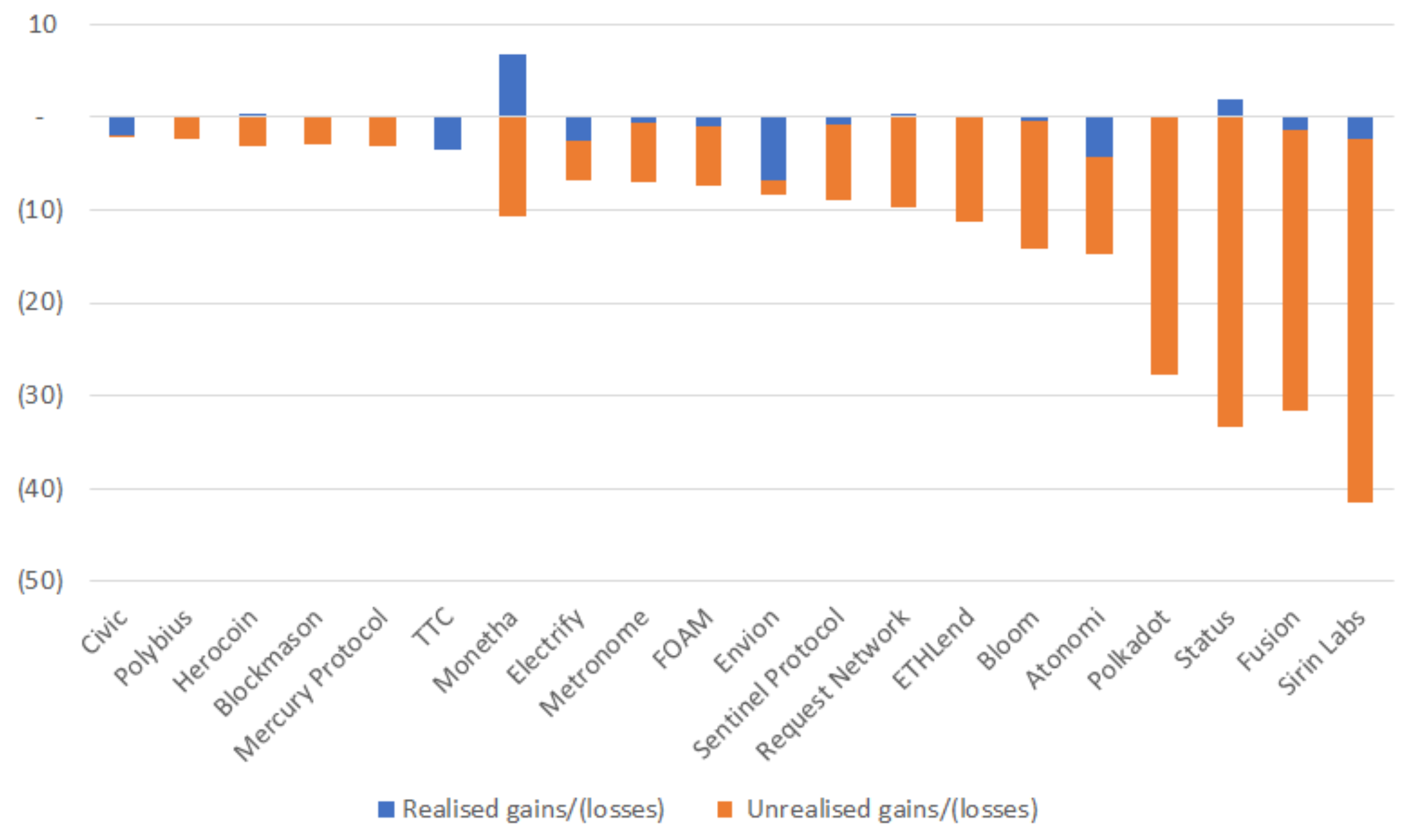

Top 20 ICO projects ranked by total loss from change in value of Ethereum holdings – US$ million

(Source: Ethereum Blockchain, BitMEX Research, TokenAnalyst, Token Data, Price data from Etherscan)

Projects ranked by reported US$ raised

| ICO | ETH Raised based on BitMEX Research analysis | US$ million value of ETH raised based on BitMEX Research analysis | Token Data reported total raise (US$ million) |

| EOS | 7,211,776 | 3,824.0 | 4,234.3 |

| Tezos | 361,122 | 88.1 | 230.6 |

| Filecoin | 461,442 | 150.4 | 200.0 |

| Sirin Labs | 88,906 | 64.1 | 157.9 |

| Bancor Protocol | 193,830 | 76.5 | 153.0 |

| Polkadot | 306,276 | 93.6 | 144.3 |

| Status | 299,902 | 105.1 | 107.7 |

| Envion | 46,735 | 42.0 | 100.0 |

| Kin | 168,732 | 46.1 | 98.5 |

| TenX | 210,500 | 64.1 | 83.1 |

| BankEx | 65,129 | 39.2 | 70.6 |

| Kyber Network | 95,947 | 24.7 | 49.3 |

| Gridplus | 10,410 | 3.1 | 45.7 |

| Fusion | 50,224 | 42.6 | 41.7 |

| Bloom | 43,871 | 27.5 | 41.4 |

| Monetha | 95,000 | 36.9 | 36.4 |

| AirSwap | 76,625 | 23.0 | 36.3 |

| Basic Attention Token | 57,645 | 13.2 | 36.0 |

| Ether Party | 12,105 | 3.7 | 33.5 |

| Request Network | 100,000 | 33.7 | 33.3 |

| Civic | 40,000 | 13.0 | 33.0 |

| Raiden Network | 109,532 | 32.7 | 31.9 |

| Polybius | 27,502 | 8.2 | 31.6 |

| Electrify | 10,639 | 9.1 | 30.0 |

| Storj | 122,000 | 19.2 | 30.0 |

| Sentinel Protocol | 26,548 | 15.1 | 27.5 |

| Paypie | 61,082 | 18.5 | 26.8 |

| Tierion | 95,985 | 18.9 | 25.0 |

| Aragon | 277,199 | 24.1 | 25.0 |

| Atonomi | 42,847 | 26.0 | 25.0 |

| aeternity | 74,271 | 17.8 | 25.0 |

| 0X | 84,647 | 25.3 | 24.0 |

| Enjin Coin | 61,584 | 19.0 | 23.0 |

| Aventus | 59,882 | 20.3 | 20.1 |

| Uptoken | 5,449 | 2.1 | 18.9 |

| Change | 48,129 | 14.3 | 17.5 |

| Covesting | 2,121 | 0.9 | 17.4 |

| Decent Bet | 52,558 | 16.0 | 16.2 |

| ETHLend | 36,486 | 11.9 | 16.1 |

| Maecenas | 50,066 | 14.6 | 15.7 |

| Cofoundit | 61,800 | 15.0 | 14.9 |

| GATCOIN | 8,975 | 5.4 | 14.7 |

| TTC | 20,489 | 14.1 | 14.2 |

| Mysterium Network | 56,322 | 12.9 | 14.1 |

| Pindify | 78,032 | 46.7 | 14.0 |

| POA Network | 41,176 | 13.7 | 13.7 |

| Cobinhood | 32,064 | 9.5 | 13.4 |

| Dragonchain | 24,972 | 7.6 | 13.2 |

| FOAM | 38,028 | 15.0 | 12.7 |

| Gnosis | 250,000 | 12.5 | 12.5 |

| iExec | 120,883 | 5.8 | 12.2 |

| Adshares | 5,492 | 2.2 | 12.1 |

| Santiment | 45,002 | 12.0 | 12.1 |

| Populous | 15,310 | 5.2 | 10.8 |

| Iconomi | 314,939 | 4.0 | 10.7 |

| Playkey | 10,248 | 3.6 | 10.5 |

| Mercury Protocol | 15,732 | 5.1 | 10.5 |

| Metronome | 26,389 | 13.1 | 10.2 |

| District0X | 43,169 | 9.1 | 9.8 |

| Indorse | 22,800 | 7.4 | 9.0 |

| Golem | 820,003 | 8.3 | 8.6 |

| Aion | 26,920 | 8.2 | 7.8 |

| Coindash | 43,488 | 8.3 | 7.5 |

| SingularDTV | 570,002 | 6.8 | 7.5 |

| Atlant | 9,294 | 2.8 | 6.6 |

| DOVU | 8,542 | 2.7 | 6.3 |

| DigixDAO | 466,648 | 3.5 | 5.5 |

| FirstBlood | 465,313 | 6.1 | 5.5 |

| Augur | 610 | 0.0 | 5.3 |

| Humaniq | 41,456 | 2.0 | 5.2 |

| STeX | 3,819 | 1.2 | 4.5 |

| Matryx | 4,209 | 1.3 | 4.5 |

| Auctus | – | – | 4.0 |

| ALIS | 13,183 | 3.9 | 3.8 |

| Crystal Clear Services | 3,542 | 1.1 | 3.4 |

| Melonport | 8,028 | 0.1 | 2.9 |

| Bitjob | 8,034 | 2.3 | 2.8 |

| Swarm Fund | 2,825 | 0.8 | 2.5 |

| Blockbid | – | – | 2.4 |

| Mingo | 3,305 | 2.2 | 2.4 |

| Privatix | 43 | 0.0 | 2.4 |

| Wolk | 17,338 | 5.1 | 2.2 |

| Herocoin | 41,044 | 12.1 | 2.0 |

| Total | 15,034,170 | 5,427 | 6,764 |

(Source: Ethereum Blockchain, BitMEX Research, TokenAnalyst, Token Data, Price data from Etherscan, Diar as a cross reference)

(Note: The totals are slightly smaller than the opening table in this report as some smaller projects have been excluded)

The peculiarities of EOS

As we alluded to above, since EOS sold its Ethereum regularly during the ICO period, we needed to use a different methodology to analyse EOS’s Ethereum holdings. We identified 171 EOS “internal transactions” which transferred Ethereum outside of the EOS address cluster. The total value of these transfers was 7.2 million ETH or US$3.9 billion based on the closing price of Ethereum on the day of each of these transfers. Using these figures and the average Ethereum price during the ICO, we believe EOS raised US$3.8 billion worth of Ethereum, reasonably close to the reported US$4.2 billion figure, which presumably includes money raised in currencies other than Ethereum.

Unlike other projects we therefore do not have the same degree of confidence that the 7.2 million Ethereum balance was not double counted (i.e. The EOS project receiving investments in the form of Ethereum and then recycling those same Ethereum coins back into the ICO to inflate the amount raised). However, we have no particular reason to believe this recycling occurred and the 7.2 million Ethereum which was transferred out of the smart contract can give a degree of assurance the raising was genuine. We are merely pointing out that the level of assurance is lower than for other projects in our analysis, based on our methodology.

Conclusion

We conclude that the ICO treasury accounts have a much lower level of exposure to the price of Ethereum than many may have thought. The ICO projects or project teams essentially made out like bandits, at least with respect to the Ethereum they raised. As a tool to raise funds, the ICOs have clearly been a phenomenal success, to such an extent that even a further significant fall in the value of Ethereum will barely make a dent into the success.

Quite what this means for the Ethereum price going forwards is unclear, however we believe we have shown the “panic sell” thesis is either false or will only occur to a lesser extent than some expect.

Whether these projects invest the money well and develop useful products and services is of course another question. In our view the level of accountability in some of these ICOs is low, for instance even obtaining information about the amount raised, which currencies the raise occurred in, which Ethereum addresses are used and if the funds are spent/sold or not, can be challenging. Therefore fruits of these investments may disappoint in our view. Actually many of these projects are competing over the same scarce resources, developers. One could argue that the volume of capital obtained by these ICOs could inflate the cost of these resources (perhaps the less experienced developers). This may not only plague the crypto-currency ecosystem with higher costs, but also to some extent some startups in the wider technology industry, for many years. Whether our cynical view is right or not, only time will tell.

Technologies

MAKE, Casper Partners With D3 To Apply For .cspr Top-Level Domain

MAKE, a blockchain technology innovation firm, with the support of the Casper Association, have announced an exclusive partnership with D3 Global, a next-generation domain name company developing interoperable digital identities, to apply for and obtain the .cspr Top-Level Domain (TLD) during ICANN’s upcoming application window.

By partnering with D3, MAKE and Casper aim to drive accessibility and growth in Web3, by cutting the barriers to access blockchain ecosystems and integrating existing Internet infrastructure used by over 5 billion people worldwide. The Domain Name System (DNS) is universally recognized and used by nearly all governments, and enterprises across the globe. Bridging Web3 and DNS uniquely fits Casper’s strategy of enabling long-term solutions to real-world business challenges.

D3’s patent-pending platform is set to integrate traditional Internet and Web3 ecosystems to deliver enhanced utility, security, and universal access for what the company calls ‘real Web3 domains.’ The company is set to change the status quo, setting its sights on existing Web3 naming solutions, which do not offer interoperability with traditional Internet infrastructure, including support for the DNS, browsers, email, smart devices and more.

“Our partnership with D3 will allow Casper to become more accessible and scalable than ever. Every single day billions of people across the world use domains to navigate the Internet, the .cspr top-level domain will allow us to bridge the gap between Internet and blockchain technology,” said Ralf Kubli, Director at Casper Association.

“We look forward to working with D3 to develop futureproof, interoperable digital identities that offer our users and partners a host of new functionality and utility within the Casper ecosystem. Domains are universal and will be key to onboarding and scaling Casper’s enterprise blockchain solutions,” said Michael Steuer, Co-Founder and CTO at MAKE.

“We’re excited to welcome MAKE and Casper on our journey to cut down the barriers between Web3 and Internet infrastructure. The Domain Name System has been instrumental in making the Internet accessible and navigable for over 40 years and soon it will make Web3 and the Casper ecosystem just as easy to access and explore,” said Fred Hsu, Chief Executive Officer at D3.

Through their partnership, the three entities aim to onboard the next billion users to Web3 through ‘real Web3 domains’ that will offer accessibility and seamless integration with billions of Internet enabled devices.

About MAKE

MAKE invests in and develops innovative technology in high-impact industries, such as public health and blockchain. In public health, MAKE enables policy makers to make data-informed decisions about public health policies on a global, national and local basis. In blockchain, MAKE specializes in developing secure and user-friendly solutions for decentralized ecosystems. With a commitment to innovation and a focus on delivering real-world benefits to users, MAKE is at the forefront of the blockchain revolution.

For more information, please visit: https://makegroup.io

About Casper Network

The Casper Association is the not-for-profit, Switzerland-domiciled organization responsible for overseeing the Casper network and supporting its organic evolution and continued decentralization. By seamlessly integrating with existing technology stacks, Casper empowers both small and large organizations to harness the full potential of blockchain technology and create solutions that address real-world challenges. Utilizing open web standards, Casper enables the rapid development of cutting-edge blockchain applications.

For more information, please visit: https://casper.network

About D3 Global

D3 Global is a digital infrastructure provider that delivers secure, decentralized, and interoperable identities on the root layer of the internet – the Domain Name System (DNS). D3’s patent-pending platform will be the first to deliver real domain names that seamlessly bridge the gap between traditional Internet infrastructure and Web3 ecosystems. D3 team consists of industry veterans with over three decades of collective experience, known for leading domain name monetization, internet protocols, and various TLD operations including .xyz, .inc, .tv, and .link.

Learn more about D3 at https://www.d3.app/

Technologies

Galactica Network introduces Web3 Identity for decentralized social networks

Galactica’s recent launch of their identity Layer 1 TestNet heralds a significant breakthrough, paving the way for under-collateralized lending and compliant Real World Assets (RWA) integration. This development holds the promise of seamlessly channeling trillions of dollars of liquidity from traditional finance (TradeFi) into decentralized finance (DeFi), reshaping the financial landscape.

Why you should care

The emergence of compliant yet privacy-preserving digital identity solutions, along with the concept of augmented reputation, represents a monumental advancement in the crypto sphere. These innovations are often hailed as the “Holy Grail” of crypto, offering a multitude of benefits.

With Galactica’s technology, expect heightened capital efficiency within DeFi, the ability to trade traditional assets such as Nvidia stocks or SpaceX equity on decentralized platforms like 1 Inch — even on weekends — and the convenience of purchasing corporate bonds or T-bills via Decentralized Exchanges (DEX). Moreover, envision securing a mortgage for a new Airbnb apartment in Tulum using your global credit score.

Beyond finance, this technology opens doors to hosting national elections securely and fostering entirely new digital communities or nations.

How it works

Galactica’s blockchain operates as a layer 1 protocol, distinguished by the introduction of groundbreaking primitives — akin to Lego building blocks — that revolutionize the landscape.

These primitives enable the creation of a compliant, privacy-preserving sovereign identity, along with the seamless validation and integration of on-chain, cross-chain, and off-chain data to construct augmented reputation systems.

Become a Galactican today and join their community, you’re still early!

About Galactica Network

Galactica Network is a layer-1 solution with the most flexible RegTech stack and DeSoc primitives. By leveraging zkKYC, dynamic whitelisting primitives and proofs over users’ Web3 footprints, it achieves a strong form of Sybil resistance and enables protocol-level, compliant privacy.

To learn more about this project, please visit its website: https://galactica.com.

Blockchain

Saakuru Leads the Gasless Blockchain Revolution, Disrupting the Industry

Saakuru announced some recently reached milestones in its development, which put it at the forefront of the gasless blockchain revolution currently disrupting the industry. The consumer-centric L2 protocol entered the top 5 brands in its niche within 9 months of launch. Moreover, according to data from DappRadar, it records over 1.44 million/week.

Saakuru is preparing for the official launch of its Saakuru token ($SKR) before the end of April. The project also successfully raised $2.4 million in an oversubscribed private funding round to develop its protocol.

The Saakuru Protocol is an up-and-coming proponent of gasless technology, considered by many an accelerator of Web3 adoption into the mainstream. Its mission is to improve the user experience for both developers and end users and drastically reduce costs. These enhancements should forever change the blockchain landscape, enabling the development of more versatile decentralized applications boasting higher security standards, cost-effectiveness, and ease of use.

As of 2024, blockchain technology is stagnating and used mainly for crypto trading. Also, the broadly adopted Ethereum model, based on gas fees fluctuating depending on network use, can lead to high costs and a disappointing user experience. Lastly, most blockchain networks face significant security issues, deterring new users from onboarding promising projects.

Saakuru has developed a public-permission, gas-less L2 blockchain powered by Oasys High-Speed Optimistic Rollups. The network’s design eliminates gas fees, significantly improves user experience, and proposes new tokenomics models. For instance, it enables the easy creation and execution of token contracts, including features like vesting, staking, data tracking, and management. This approach differs significantly from most layer-2 blockchain networks, which rely primarily on governance tokens.

The Saakuru token is a multi-purpose token ensuring utility and governance for the Saakuru Protocol. It uses an advanced burning mechanism to gradually reduce its supply while potentially increasing its value. The token is involved in all the operative layers of the Saakuru protocol:

- Developer Layer—Also known as Saakuru Labs, this feature provides several products and services with proprietary business models. The system burns the token with 10% of the profit.

- DeFi Layer — This feature is facilitated by Taffy DEX technology, and 0.005% of every fee collected from on-chain and cross-chain transactions throughout the Taffy DEX protocol is converted to SKR tokens and burned.

- Governance Layer — SKR token holders can use their tokens to participate in the protocol’s governance model. Moreover, 5% of the tokens used to initiate the review process are burned.

- Protection Layer — The SKR token is burned if the SKR token protection mechanism is triggered, and 3% of saved tokens will be burned.

The Saakuru team believes the protocol’s gas-less operations will drive quick and consistent adoption of the SKR token. Moreover, developers can stake their SKR tokens to refill their credit balances monthly and drive the ecosystem’s growth.

Another aspect that should increase demand for gas-less blockchain networks like Saakuru is the outdated properties of the currently available external wallet model. The Saakuru team believes developers and users will soon adopt the embeddable model, defined by increased security and numerous configurable features in any mobile app in one day. This type of wallet can provide a better, user-friendlier experience without reducing security.

The Saakuru protocol will also feature prebuilt, easy-to-launch modules for basic Web3 interoperability functions, such as smart contract event tracking and interaction APIs. It will also have an NFTs CRM and zkNFTs verification layer, allowing businesses to integrate Web3 technologies seamlessly into their operations.

About Saakuru

Saakuru takes a new, innovative approach to Web3 and proposes a blockchain that doesn’t charge gas fees, maintains stability through top security practices, and fosters new projects, applications, and ideas. To this end, the team launched the Saakuru Developer Suite, a comprehensive toolset that includes libraries and APIs and enables developers to create applications faster.

The development team behind Saakuru has more than ten years of experience making Web2 products and six years of experience in Web3 applications, both from the developer’s and business sides. Their experience enabled them to discover the primary issues of decentralized production that prevented them from reaching mainstream use.

Saakuru benefits from increasing support from the industry, including prominent educators on blockchain technology, such as Ivan on Tech, an angel investor in the Saakuru Protocol.

Business

XVC Tech Announces Strategic Investment in TradeTogether to Enhance Web3 Wealth Management

XVC Tech, has invested in TradeTogether, a leading Web3 wealth manager based in Singapore. The venture capital firm founded by the creators of the XDC Network blockchain.

XDC Network’s ecosystem includes RWA dApps focusing on Private Credit (TradeFinex), Trade Finance (XDC Trade Network), tokenized gold (Comtech Gold) and tokenized US Treasuries (Yieldteq powered by Tradeteq).

Ritesh Kakkad, co-founder of XVC Tech, noted, “TradeTogether approached XVC with a strong emphasis on compliance, which is key in sectors like private credit and trade finance. We believe this focus on compliance will attract more institutional adoption, leading to increased utilization of the XDC Network’s use cases.”

Added TradeTogether’s CEO Geoff Ira, “XDC Network is a robust Enterprise-grade Layer 1 blockchain with a strong focus on Real-World Assets (RWA). We eagerly anticipate collaborating with XDC and its ecosystem of dApps to develop top-tier Web3-centric funds, driving intelligent capital into RWAs and Web3, while adhering to regulatory compliance standards.”

TradeTogether introduces two innovative investment options

- Firstly, the TradeTogether Bitcoin Advantage Fund, allows clients to invest in Bitcoin with added protection against market downturns, offering a better experience than traditional ETFs.

- Additionally, TradeTogether provides high-net-worth individuals and financial institutions with transparent solutions in tokenized bonds and Web3 products for receivable financing, moving away from the DeFi platform model.

TradeTogether has prominent co-investors such as Orbit Startups, Tenity, Boleh Ventures and Leo Ventures. Other Angel investors who participated in TradeTogether’s funding round since it’s inception includes Samuel Rhee (Chairman of Endowus), Varun Mittal (Group Head Innovation Singlife), Reuben Lai (Former Senior MD Grab Financial Group), Mx Kuok (KUOK Family), E. BABA de Rothschild (EGR Partners), Chandrima Das (Ex bento founder acquired by Grab), Nicolas Gallet (Gallet Capital), David Bachelier (CEO Asia at Flowdesk).

About XVC Tech

Founded by the co-founders of XDC Network, Atul Khekade and Ritesh Kakkad, XVC Tech is a US $125mn Fund focussed on exploring investment opportunities in NextGen Technology Solutions. Portfolio companies include DeGaming, a decentralized i-gaming infrastructure protocol, Bolero, a platform fractionalizing IP of music assets via smart contracts or Truflation, an oracle for RWA, indexes and inflation.

Current areas of focus include RWA, Web3 infrastructure, AI, and DePIN. For Web3 startups looking to make an impact, new investment opportunities are actively being sought. Users interested in learning more can visit XVC Tech at XVC.Tech to get in touch.

About XDC Network

The XDC Network is an open-source, carbon-neutral, enterprise-grade, EVM-compatible, Layer 1 blockchain, operational since 2019 focusing on Enterprise use cases such as Trade Finance, Payment and RWA tokenization. More details at: Xinfin.org

About TradeTogether

TradeTogether Pte Ltd is a pioneering Web3 digital asset management company based in Singapore. Operating under a regulatory exemption since October 25, 2021, TradeTogether is at the forefront of innovative financial solutions in the digital asset space. Led by CEO Geoff Ira, who has a strong background in the financial and banking industry. For more information, users can visit TradeTogether.com

Technologies

Multis Team Joins Safe to Build Cross-Chain Smart Wallet Infrastructure

Safe, the leading smart wallet infrastructure, with more than $100 billion in value of digital assets secured, has welcomed the senior leadership team of Multis to the Safe Ecosystem Foundation and completed the strategic acquisition of the Multis source code; Multis is an all-in-one financial software designed for crypto businesses. At the same time, Thibaut Sahaghian, the former CEO of Multis, is set to take on the new role of Network Abstraction Lead as a core contributor within the Safe ecosystem, where he and his team will continue their work towards enabling businesses and individuals to adopt and easily use digital assets every day.

With this move, Safe embarks on the next phase of its mission to simplify, improve, and enhance Web3 user experience. Leveraging their unique collective expertise, the Safe and former Multis team members will collaborate to solve the complexities of cross-chain interaction through network abstraction, with the end goal of enabling users to manage assets across diverse blockchain networks effortlessly.

As crypto usage soars, the demand for faster and more cost-efficient transactions has led to the rise of Layer 2 networks built atop the Ethereum mainnet (Layer 1), aiming to enhance scalability. However, this growth has considerably fragmented the blockchain landscape, complicating the development of user-friendly, on-chain applications and wallets. Addressing this complexity through network abstraction, which simplifies asset management across various blockchains, is crucial for setting the stage for mainstream adoption—a vital goal for the Ethereum community.

“The demand for Safe’s services is skyrocketing, particularly from emerging L2 ecosystems seeking robust infrastructure support to help users manage their digital assets. As we expand, simplifying the cross-network experience becomes crucial,” noted Richard Meissner, co-founder of Safe. “The synergy between Multis and Safe will undoubtedly help us become a staple in these evolving networks and beyond.”

Thibaut added, “Joining Safe is a game-changer for us. We’ve already been harnessing Safe’s robust infrastructure for years, and this is a new journey for us. It empowers us to broaden our mission, tapping into Safe’s expansive platform and extensive user base. Together, we’re set on building an ecosystem where digital assets and applications interact seamlessly across multiple networks, easing the path to adoption and creating a more integrated blockchain world.”

This strategic acquisition marks a turning point for Safe. It aligns with Safe’s recent collaboration with Coinbase-incubated Base to make smart accounts the standard on Ethereum. This announcement furthers Safe’s commitment to providing a seamless and secure foundation for managing assets within exploding L2 ecosystems on Ethereum.

About Safe

Safe (previously Gnosis Safe) is an onchain asset custody protocol, securing ~$100 Billion in assets today. It is establishing a universal ‘smart account’ standard for secure custody of digital assets, data, and identity. With Safe{Wallet}, it’s flagship web and mobile wallet and Safe{Core} account abstraction infrastructure, Safe is on a mission to unlock digital ownership for everyone in web3 including DAOs, enterprises, retail and institutional users.

About Multis

Multis offers a comprehensive financial software solution, empowering DAOs and enterprises to seamlessly manage transactions with both USD and digital assets, across multiple networks. Historically backed by Sequoia Capital and Y Combinator, Multis has been a front-runner in enhancing the crypto business user experience, now set to amplify its impact with Safe.

Blockchain

Linea Going from Strength to Strength with Lynex on the Front Lines

The Linea blockchain has gone from strength to strength over the last quarter, seeing TVL and volume soar. Lynex and its ingenious community engagement strategy stand as a key contributor to this organic growth.

This impressive achievement highlights the strength and potential of the Linea ecosystem, a product of the renowned blockchain software houseConsenSys, which is also known for owning the popular cryptocurrency wallet MetaMask. With its lattice-based cryptography, which is faster, less computationally heavy and easier to implement than other cryptography methods, Linea is a key player in the market of Layer 2 scaling solutions for Ethereum.

Linea has seen mass organic growth with TVL tripling over the last trimester and volume quadrupling in the last month. Part of this growth has been thanks to the community efforts in bolstering liquidity and driving engagement, coordinated by Lynex, the leading DEX and native liquidity layer on Linea.

Lynex, the top DEX on the network boasts an elevated rendition of the ve(3,3) DEX model and has contributed greatly to the organic growth and engagement on the network, with TVL on the protocol seeing a 1600% increase in the last month at the time of writing. Through a community-centric airdrop mechanism, Lynex is incentivizing investors to explore the ecosystem to use other protocols, to maximise their chances of airdrop, which has proven to be quite an effective tactic in driving growth.

Lynex’s Recent Milestones

The surge in TVL is a testament to the increasing confidence and interest from the DeFi community in the Linea blockchain and its associated projects, particularly Lynex. The platform has played a crucial role in this growth, thanks partly to its strategic community airdrop, which has successfully attracted a wider user base and fostered a more engaged and vibrant community.

A total of 10% of Lynex’s initial supply has been earmarked for distribution to holders of existing ve-like protocols and those who have actively engaged with the Lynex community. This strategic airdrop is a testament to Lynex’s dedication to fostering a strong, engaged, and empowered community, and truly embodying the role of being a native liquidity layer. Lynex aims to create a more inclusive and collaborative ecosystem that benefits all stakeholders by rewarding our users for their loyalty and participation.

Lynex has also been named the official DEX partner of Linea’s much-celebrated community coin, FOXY. This partnership comes after Lynex had seen mammoth growth in TVL and token price over the last quarter and solidifies its place at the top of the food chain in the Linea ecosystem.

Lynex’s Innovative Tokenomic Model Helps Drive Growth

Lynex continues leading the way in DeFi innovation with its advanced Automated Liquidity Management (ALM) and unique tokenomics. The ALM feature allows users to optimize their liquidity provision, reducing the risks associated with impermanent loss and ensuring more stable and profitable returns. Meanwhile, Lynex’s tokenomics model is designed to align the interests of liquidity providers, token holders, and the broader ecosystem, creating a more sustainable and rewarding platform for all participants.

Lynex’s innovative tokenomics model, oTokenomics, is revolutionizing the DeFi ecosystem by addressing critical challenges such as token devaluation and incentive misalignment for Liquidity Providers (LPs). This model aligns user and protocol interests, ensuring long-term stability and growth.

The “Darkpool” Is Coming

Lynex is also set to disrupt the liquidity provision landscape very soon by introducing its groundbreaking ‘Darkpool’ technology on the Linea blockchain. Developed in collaboration with security experts at Salus Security, this cutting-edge innovation promises to bring unparalleled privacy to the trading world.

By leveraging the power of zero-knowledge proofs, zkLynex’s Darkpool technology ensures that traders can execute their transactions with complete confidentiality, protecting both their strategies and market positions.

About Lynex

Lynex is a leading decentralized exchange (DEX) and liquidity marketplace built on the Linea blockchain. With a focus on innovation, security, and user experience, Lynex aims to provide a seamless and efficient trading platform for the DeFi community. The platform features advanced technologies such as Automated Liquidity Management (ALM), innovative ve(3,3) DEX model and tokenomics, and soon, Darkpools for enhanced privacy in trading.

About Linea

Linea is a Layer 2 blockchain developed by ConsenSys, the company behind MetaMask. It offers a scalable and secure platform for EVM decentralized applications (dApps) and decentralized finance (DeFi) projects. Linea’s rapid growth and increasing Total Value Locked (TVL) reflect its potential to become a leading blockchain for DeFi and beyond.

Altcoins

Numun Ecosystem Launches to Bring a Complete Set of Apps for Real-World Assets On-Chain

The Numun Ecosystem today launches, comprising applications Num and Vectium and offering a structured approach to real-world asset (RWA) tokenization and lending on the Ethereum network.

Num, the first app of the Numun Ecosystem, is a Bermuda-based tokenization company, that specializes in tokenizing traditional finance (TradFi) assets, including ETFs, stocks, and bonds. In 2023, Num successfully closed a USD 1.5 million pre-seed funding round to work on its first MVP, emerging market stablecoins, which garnered 500,000 users within its first year. Num now aims to achieve global reach by tokenizing TradFi assets into fully backed, permissionless forms known as nTokens, bridging the gap between the TradFi and DeFi realms.

The second app in the Ecosystem is called Vectium, an innovative RWA lending protocol that harnesses the power of nTokens to facilitate financial interactions, enabling users to lend and borrow stablecoins against nTokens and soon more RWAs. This system also supports users in leveraging and hedging TradFi assets in a manner that is both permissionless and secure.

Speaking on the launch, Agustin Liserra, CEO of Num Finance, said, “Numun ignites the power of synergy between transparency and innovation. Our commitment lies in steering the course of finance towards a future where accessibility, security, and empowerment are not just ideals, but everyday realities for DeFi users. As we unveil Numun to the world, we stand on the brink of a new financial era – one that we are proud to shape and lead.”

Central to orchestrating the Numun Ecosystem is the Numun Token, which employs a unique value accrual mechanism. Up to 40% of the revenue generated by the lending protocol is allocated to a buy-back-and-burn strategy for the Numun Token. The Numun token will be used across all of the apps within the ecosystem, ensuring its value is intrinsically linked to the success of Numun as a whole.

Numun Ecosystem is partnering with Impossible Finance to bring the Numun Token to the market, Calvin Chu, Co-Founder, and Core Builder of Impossible Finance, expressed excitement about partnering with Numun and supporting their mission of bridging traditional and decentralized finances. Calvin said, “Num’s and Vectium’s approach to bringing permissionless tokenized assets is the correct way to maximize interoperability. The strategy to bring a wide coverage of financial products on-chain is definitely filling a gap in the current landscape.”

Speaking on the significance of the development for the DeFi ecosystem, Alex Kruger, Advisor and Strategic Director at Num Finance, said, “The Numun ecosystem represents the culmination of our enduring commitment to reshaping the DeFi landscape. After years of meticulous work, we are introducing an on-chain ecosystem that makes real-world assets the epicenter. This is the advancement that the DeFi space has been waiting for — a transformative step in aligning the reliability of traditional assets with the innovation of decentralized finance.”

Agustin Liserra, CEO of Num Finance, is available for interviews.

Alex Kruger, Advisor and Strategic Director at Num Finance is available for interviews.

About Num Finance

Num Finance is a Bermuda-based technology firm at the forefront of real-world asset (RWA) tokenization. By facilitating the conversion of traditional financial assets into digital tokens, Num Finance integrates these assets with the decentralized finance (DeFi) sector. Focused on security, transparency, and accessibility, Num Finance enables broader access to financial markets and improves liquidity through innovative financial services. Committed to compliance and effective risk management, Num Finance adheres to strict regulatory standards, ensuring a trusted and stable platform for investors navigating the evolving landscape of digital finance.

For more information, visit num.finance

News

Etherland Tecra Space Crowdfunding Goes Live

The Etherland Tecra Space campaign has officially gone live, giving participants the opportunity to stake their claim in a real-world assets (RWA) blockchain project that approaches on-chain real estate with a unique angle.

This campaign aims to accelerate the development of innovative RWA solutions powered by blockchain technology for the real estate industry. In the months leading up to the crowdfunding initiative’s launch, Etherland’s native $ELAND token has appreciated by over 300% as the project positioned itself at the forefront of the RWA narrative.

Tecra contributors will earn exclusive rewards through a tiered system offering a variety of perks based on their level of support. The Etherland team is leveraging the campaign to redefine the real estate market with document management tools powered by blockchain technology.

Etherland’s RWA Vision and the Tecra Space Campaign

The traditional real estate sector is fraught with inefficiencies, from outdated paperwork systems to reliance on intermediaries. These complexities lead to delays, increased costs, and a lack of transparency for buyers, sellers, and investors.

Etherland’s mission is to disrupt these outdated practices by harnessing the power of blockchain technology. Their focus lies in developing innovative solutions for RWAs, centered explicitly around streamlining property transactions, enhancing security, and unlocking new investment opportunities.

Funds raised through the campaign will directly fuel research, development, and expansion of essential tools and technologies. This translates into building a robust ecosystem where complex real estate processes can be simplified, creating efficiencies that benefit all stakeholders.

Etherland’s RWA solutions offer tangible benefits. Secure and tamper-proof records facilitate faster transactions with enhanced transparency, minimizing the risk of errors or disputes. New forms of asset-backed financing and real estate investment models become possible, potentially making the market more accessible.

Tiered Rewards: Earning Exclusive Perks

The Tecra Space campaign features a reward system designed to incentivize participation and recognize the contributions of supporters at different levels. Contributors can select a tier that aligns with their desired level of support, with increasingly valuable rewards unlocked at higher tiers.

Types of Rewards

The rewards offered through the Tecra Space campaign span a wide range to appeal to various interests. Every reward tier comes with a tradable NFT certificate, which gives the holder voting power in the Etherland DAO; the number of votes afforded to users increases as they move up the reward tiers.

Bonus minting credits can also be earned, which will unlock exclusive features, including staking bonuses. Top contributors are offered exclusive, limited-edition merchandise linked to especially NFTs.

Top-Tier Exclusivity

The highest tiers within the Tecra Space campaign earn rare, unreleased NFTs from Etherland’s established collections or custom NFTs designed exclusively for the campaign. Top-tier contributors are also eligible to obtain cutting-edge HoloFans, devices that enable 3D holographic displays of blockchain-linked NFTs. In addition, top-tier NFT certificates give users a particularly large number of votes in the DAO, which will make them key players in the decision-making processes driving Etherland forward.

Beyond the Rewards: Shaping the Future of Real Estate

Arguably, participation in the Tecra Space campaign offers something even more profound than rewards; it presents the opportunity to actively shape the real estate industry’s future. Every contribution helps advance real-world solutions that can potentially disrupt legacy real estate processes for the better.

By supporting this campaign, contributors become part of a community dedicated to building a more efficient, transparent, and accessible real estate ecosystem. The innovations planned by the team aim to streamline real estate transactions, enhance security measures, and unlock new investment models.

Etherland’s RWA technologies extend beyond immediate applications within the real estate sector. The platform’s focus on secure document management, tamper-proof records, and reliable asset tracking provides a solid foundation for use cases across various industries.

Therefore, contributors to the Tecra Space campaign play a pivotal role in driving innovation, which has far-reaching implications for redefining how we interact with real-world assets in real estate and other sectors.

Final Thoughts on Etherland’s Tecra Space Crowdfunding Initiative

The Tecra Space campaign launched on April 9th, marking a significant milestone in Etherland’s journey to revamp the real estate industry with blockchain-powered RWA solutions. This campaign offers the opportunity to earn exclusive rewards and become a key player in the DAO while driving innovation and shaping the future of on-chain RWAs. Become a part of Etherland’s journey by visiting the official Tecra Space page today.

News

Covalent (CQT) Announces Grants Program & API Credits for Cronos Ecosystem, Supercharging Future Web3 Innovation

In a significant step toward fostering innovation in Web3, Covalent is excited to announce that it is extending its grants program to developers within the Cronos ecosystem. This strategic move aims to catalyze innovation and collaboration by providing support and resources to projects building on top of Covalent’s API infrastructure within the Cronos network.

Covalent stands out as an unparalleled solution for Cronos developers seeking to enhance their projects with real-time, historical onchain data. With the capacity to query data from over 100 billion decoded transactions across 225+ blockchains, Covalent’s Unified API stands as the largest and most comprehensive structured Web3 dataset. Noteworthy for its cryptographic security and adherence to enterprise-grade reliability, Covalent’s dataset further distinguishes itself by offering decentralized means of accessing Web3 data–driving innovation within the Cronos ecosystem.

Key to fostering innovations in categories including decentralized finance (DeFi), AI and machine learning, gaming, NFTs, analytics, and more, this extensive access equips Cronos developers with a fundamental foundation for innovation across a diverse array of blockchain use cases. By leveraging Covalent’s API, developers can tap into a rich reservoir of structured data that fuels their dApps, enabling them to gain valuable insights and drive innovation with confidence.

Through the Covalent API Grants program, developers within the Cronos ecosystem have the opportunity to receive expert mentorship and funding of up to $25,000 in API credits to support their projects. This financial support not only accelerates development but also fosters a dynamic ecosystem of innovative solutions on Cronos, propelling the platform’s growth and impact.

Since its launch in fall 2023, the Covalent Grants program has awarded nearly $600,000 to 40 groundbreaking projects, spanning a wide range of categories from DeFi to data analytics to security enhancements and crypto AI projects. With the largest set of verified onchain data in Web3 at their disposal, developers on Cronos have the tools they need to build and innovate with confidence.

This announcement represents a shared commitment to advancing blockchain technology and empowering developers worldwide. Through collaborative initiatives like this, Covalent and Cronos aim to democratize access to data and foster a thriving ecosystem of decentralized applications, driving the next wave of innovation in the blockchain space.

About Covalent

Covalent (CQT) is the home for Web3 data, enabling millions of users to build the new economy of products in AI, Big Data, and DeFi. Its deep commitment to democratizing access to structured data is delivered through a singular Unified API for everyone. A pillar of the DePIN ecosystem, Covalent serves developers, analysts, innovators, and 1000’s of customers with comprehensive, real-time data access to +225 blockchains and growing. Learn how Covalent is building the long-term data availability ‘Ethereum Wayback Machine’.

About Cronos

Cronos is the leading Ethereum-compatible layer 1 blockchain network built on the Cosmos SDK. Supported by Crypto.com and more than 500 app developers and partners, its mission is to make it easy and safe for the next billion crypto users to adopt Web3, with a focus on decentralized applications in the DeFi, NFTs and GameFi verticals.

Altcoins

Xuirin Finance a pioneer for DeFi card – presale stage 1 sold out

Xuirin Finance has recently presented its DeFi card, an innovative solution designed to merge the functionalities of traditional debit and credit cards with the decentralized financial services provided by DeFi. The introduction of this card aims to facilitate daily transactions using cryptocurrencies, enhancing their integration into the global payment ecosystem.

Overview of Xuirin Finance’s DeFi card

The DeFi card from Xuirin Finance allows users to engage in a variety of financial transactions, including online purchases, bill payments, and cash withdrawals at ATMs, using cryptocurrencies. This initiative is part of Xuirin Finance’s efforts to increase the accessibility and practical use of digital currencies in everyday financial activities.

Presale stages and token distribution

During the initial presale stage, Xuirin Finance offered 15 million tokens at a price of $0.03 each, reaching a funding cap of $450,000. Following the completion of Stage 1, the company is preparing for the second stage of the token presale, which involves offering 25 million tokens priced at $0.04 each, with a funding goal of $1 million.

Xuirin Finance’s $500K mega giveaway

In conjunction with its ongoing presale, Xuirin Finance has announced a Mega Giveaway, totaling $500,000 in prizes. This giveaway includes substantial rewards for 20 winners, designed to engage and expand the community around Xuirin Finance’s offerings. Participation in the giveaway requires a minimum investment in the presale, with additional engagement opportunities provided to enhance winning chances.

Key geatures of Xuirin Finance’s offerings

Xuirin Finance has integrated several features into its DeFi card, focusing on enhancing the practicality of cryptocurrencies for everyday transactions. These features include seamless online shopping, bill payments, and ATM withdrawals with digital currencies. The initiative reflects the company’s aim to improve the infrastructure supporting the broader adoption of decentralized finance technologies.

This section still highlights the value provided by Xuirin Finance, but in a way that sticks strictly to describing features without implying enthusiasm or encouraging investment.

Future outlook for Xuirin Finance

As the presale progresses and Xuirin Finance continues to enhance its services, the company is focused on broadening the practical use of cryptocurrencies in everyday financial transactions. This initiative aligns with ongoing developments in the cryptocurrency sector aimed at enhancing user accessibility and convenience.

About xuirin

xuirin Finance is a groundbreaking DeFi platform dedicated to transforming the decentralized finance landscape. With a mission to bridge the gap between traditional finance and DeFi, Xuirin introduces innovative solutions such as DeFi Debit Cards, AI-Enhanced P2P Lending, and a secure, multi-chain DeFi Wallet. Designed for accessibility and user empowerment, Xuirin aims to redefine financial transactions, making them more efficient, transparent, and inclusive.

For additional information on Xuirin Finance and to participate in the ongoing presale, users can visit:

Website: https://xuirin.com/

Linktree: https://linktr.ee/xuirin

-

Technologies2 weeks ago

Technologies2 weeks agoWaterfall Network Launches New Desktop App for Windows and macOS

-

Blockchain3 weeks ago

Blockchain3 weeks agoICB Network Enters New Era of Blockchain Technology With Advanced Layer 1 Project

-

Blockchain2 weeks ago

Blockchain2 weeks agoParagon Network Unveils Test Net, Showcasing Breakthrough Capabilities in Decentralized Computing

-

Business2 weeks ago

Business2 weeks agoCardano Spot & TapTools Join Hands For News & Data Sharing

-

Technologies2 weeks ago

Technologies2 weeks agoRaindex Launches On Flare To Power Decentralized CEX-Style Trading

-

News2 weeks ago

News2 weeks agoChangelly surpasses 7 million users, celebrating its 9th anniversary

-

Business2 weeks ago

Business2 weeks agoNew Collaboration: IPMB Partners with Sumsub for Enhanced Security and Customer Experience

-

Blockchain2 weeks ago

Blockchain2 weeks agoSwirlds Labs Brings Open Source HashioDAO Framework to the Hedera Network, Making DAO Formation Simple, Accessible, and Inclusive for All Web3 Communities

You must be logged in to post a comment Login