News

South Korea Lawmakers Discuss ICO

South Korea has commenced an extraordinary session in the National Assembly to discuss regulation and measures to promote the cryptocurrency industry alongside ICO guidelines to eventually overturn the ongoing ban.

According to a Business Korea report on Monday, the short session – extraordinary sessions cannot exceed 30 days – in South Korea’s National Assembly will see relevant standing committees and lawmakers from parties across the political spectrum ‘discuss measures to promote the blockchain and cryptocurrency industry and create a guideline on initial coin offerings (ICOs)’.

The developments come at a time when lawmakers hasten to fast-track domestic regulations for the cryptocurrency sector with draft bills expected to be submitted during the session.

The session has seen lawmakers call on the Ministry of Science and the Information and Communications Technology (ICT) Ministry to prepare ICO guidelines for investor protections. The sessions are expected to field discussions calling for ICOs to be allowed in South Korea, with relevant investor protection safeguards in place.

As reported in May, the National Assembly’s Special Committee on the Fourth Industrial Revolution called on the government to allow domestic ICOs, accusing authorities of ‘neglecting duty’ following a sweeping, knee-jerk ICO ban that followed China’s lead nearly a year ago.

“Entrepreneurs looking to innovate should be allowed to raise funds through cryptocurrency,” Jeju Island governor Won Hee-ryong was quoted as stating in his call to allow ICOs on the island.

The session will also hear and deliberate the recent proposal from Jeju Island’s governor in seeking to create a ‘special zone’ for the blockchain and cryptocurrency sector wherein fundraising through ICOs will be permitted despite the current ban in the mainland.

Jeju Island, Korea’s most popular tourist island that sees a large number of domestic visitors, made the proposal to become a designated ‘special zone’ for the industry in a meeting with senior government figures that included Kim Dong-yeon, Korea’s finance minister, earlier this month.

Business

Magic Eden Partners With D3 To Apply For .magic Top-Level Domain

D3 Global, a next-generation domain name company developing the first on-chain domain network, today announced an exclusive partnership with Magic Eden, the leading cross-chain NFT platform, to apply for and obtain the .magic Top-Level Domain (TLD). This partnership will enable Magic Eden to seamlessly integrate with critical Internet infrastructure, which will streamline the onboarding of regular internet users, developers, and Web3 communities alike.

Once the .magic TLD is approved by ICANN, the organization that manages and maintains the Internet’s core infrastructure, the D3 network will allow for real .magic domains to be used across the traditional internet and Web3. Users will be able to utilize a single .magic domain as a website and email address, while also leveraging it for web3 applications such as wallets and verified credentials.

Fred Hsu, CEO and co-founder of D3, commented on the news: “While many communities have attempted to build their own web3 identifiers, these solutions don’t actually connect to the broader internet. Our partnership with Magic Eden is intended to marry the many benefits of Magic Eden’s web3 ecosystem with crucial connections to traditional internet users. We believe this is the only way to truly grow the web3 community – by onboarding billions of internet users and meeting them where they are.”

Through D3’s on-chain network, developers and blockchain projects will be able to create truly interoperable dApps, platforms, and services that not only enhance the utility of Web3 but also tap into existing internet infrastructure used by over five billion people worldwide.

“The Magic Eden community is at the heart of everything we do, and we are excited to provide users with their own .magic domain in partnership with D3,” said Chris Akhavan, Magic Eden Chief Revenue Officer. “Billions of Internet users use domains to access and navigate the web daily, and soon they will be able to do the same within the Magic Eden ecosystem, welcoming new users to experience the benefits of Web3 without sacrificing the Web2 functionality they’re accustomed to.”

D3 and Magic Eden will submit the application for the .magic TLD during ICANN’s upcoming application window. This is the first major new generic TLD application window since 2012, and only the second in ICANN history, presenting a unique opportunity for web3 communities to establish their domain presence. D3 Global supports leading companies across the web3 and blockchain industry and will announce additional partnerships in the near future.

About D3 Global

D3 Global is developing the first interoperable on-chain domain network that will deliver secure, decentralized, and interoperable identities on the root layer of the internet – the Domain Name System (DNS). D3’s patent-pending platform will be the first to deliver real domain names that seamlessly bridge the gap between traditional Internet infrastructure and Web3 ecosystems. D3 team consists of industry veterans with over three decades of collective experience, known for leading domain name monetization, internet protocols, and various TLD operations including .xyz, .inc, .tv, and .link.

Learn more about D3 at https://www.d3.inc

About Magic Eden

Magic Eden is the leading cross-chain platform shaping the future of Web3. Beyond its leading NFT marketplace, Magic Eden is a comprehensive, user-friendly ecosystem including a secure cross-chain wallet. Empowering users to mint, collect, and trade digital assets across blockchain networks, Magic Eden brings cultural moments onto the blockchain, fostering creativity and community engagement. Explore the future of digital ownership at magiceden.io.

Blockchain

dVIN Labs Launches dVIN Protocol from Stealth to Tokenize the $1T Wine Asset Class

dVIN Labs, the development team behind the dVIN protocol, today announced the launch of the dVIN Protocol (“dVIN” or the Protocol) from stealth. The dVIN protocol is built on Solana and is designed to leverage a combination of data, DePIN and tokenization to bring wine, a $1T real world asset class, on-chain.

David Garrett, Co-Founder & CEO of dVIN Labs, commented on the news, “We’re thrilled to announce the launch of dVIN Labs’s first protocol, dVIN, from stealth. By transforming each bottle into a unique digital asset, the tokenization of luxury wine enhances the social and economic dimensions of wine collecting and investing.”

The launch of dVIN is marked by the introduction of the Cellar Challenge, an initiative that enables participants to earn points by tokenizing bottles from their home cellar, and then opening those bottles and sharing each bottle with up to 12 friends to earn Tasting Tokens. Exclusive to dVIN, Tasting Token™ NFTs (“Tasting Tokens”) are functional NFTs connected to a Digital Cork™ NFT (“Digital Cork”). When a bottle is tokenized, it’s linked to a Digital Cork NFT on the blockchain. Tasting Tokens are minted when these bottles are opened and the Digital Cork is destroyed.

Collecting Tasting Tokens grants access to exclusive experiences and special rewards from winemakers. Over time, these NFTs serve as an immersive virtual tasting journal, allowing winemakers to engage directly with consumers at the moment of enjoyment and offer tailored incentives. The Cellar Challenge will not only generate valuable data but also facilitate the rapid acquisition of new users. Additionally by unlocking “Beast Mode,” luxury wine enthusiasts can rack up additional points in the challenge by competing to conquer one of the five leaderboards.

Club dVIN (or “the Club”), is the world’s premier global wine club providing members access to unparalleled wine experiences and exclusive benefits. The Club’s ~1,000 early adopters along with several of dVIN’s partner communities – including RealVision, CryptoMondays, Friends with Benefits, Madlads among others – will have the ability to join the Cellar Challenge early. For instance, RealVision ProCrypto members will receive special access and points, with every member getting at least 12,000 points if they join the challenge, and can earn up to 48,000 points if they complete all the quests!

Points accumulated in the Cellar Challenge will translate to a $VIN airdrop at the time of the token launch in Q3 2024 and others to be announced. For more information on the mechanics of the $VIN Token, see the $VIN Whitepaper.

Garrett concluded, “The Cellar Challenge will help wine enthusiasts engage with their collections and share their experiences, serving as both a sandbox and proof of concept, to showcase the capabilities of dVIN.”

dVIN Labs also recently partnered with SegMint GmbH (“SegMint”), a digital assets management platform, to fractionalize 12 bottles (0.75L) of Weingut Egon Müller 2022 Riesling Scharzhofberger Auslese, making them for sale via the platform here. Egon Müller is the only German producer to belong to the world’s most exclusive alliance of the 12 best family-owned wineries, Primum Familiae Vini, and its wines are some of the most coveted and collectible in the world, but also among the most costly ounce for ounce.

Which makes these bottles ideal first candidates for the first set of luxury wines offered as a more reasonable fractionalized investment via the SegMint platform. This is the first of many luxury wine listings that dVIN Labs plans to organize with luxury wine listings planned for RWA marketplaces like Jupiter’s Giant Unified Marketplace (“GUM”) and others to be announced.

About dVIN Labs

dVIN Labs is the development team behind the dVIN protocol which is designed to leverage a combination of data, DePIN and tokenization to bring wine, a $1T real world asset class, on-chain. The dVIN Protocol leverages blockchain technology to both allow wine enthusiasts to monetize their data and be rewarded for their wine activity, purchases, and loyalty. While winemakers simultaneously incentivize these wine lovers to share consumption data and personal data in order to drive deeper consumer relationships, making their businesses more responsive, efficient and profitable. To learn more about dVIN Labs and the dVIN Protocol, please visit: https://dvinlabs.com

Business

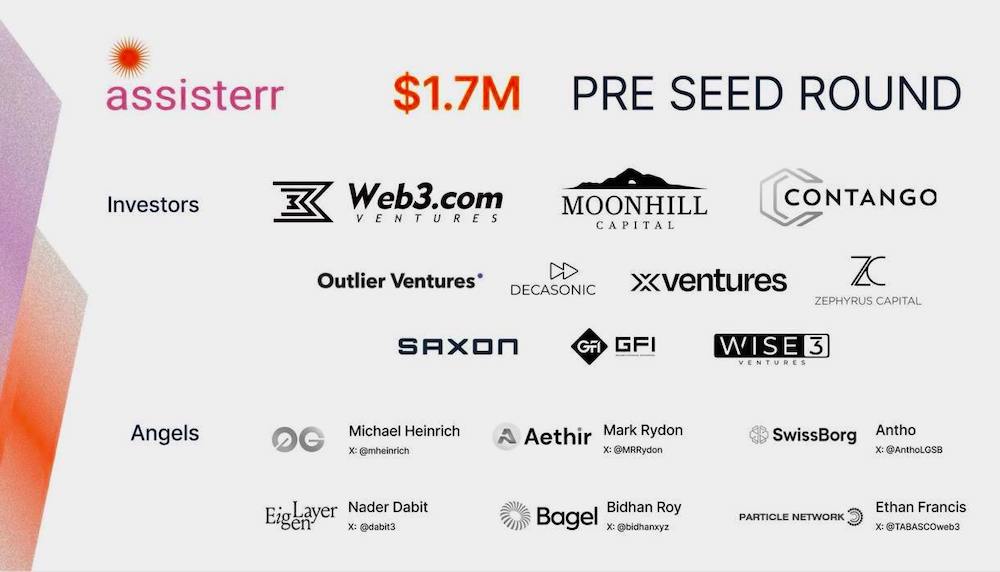

Web3 AI platform Assisterr raised $1.7M pre-seed round to enable community-owned AI

Assisterr, a Cambridge-based AI Infrastructure startup dedicated to revolutionizing artificial intelligence through community ownership and a network of small language models, has successfully closed a $1.7 million pre-seed funding round. The investment round saw participation from prominent Web3 venture funds including Web3.com Ventures, Moonhill capital, Contango, Outlier Ventures, Decasonic, Zephyrus Capital, Wise3 Ventures, Saxon, GFI Ventures, X Ventures, Koyamaki, Lucid Drakes Ventures, and notable angels, including Michael Heinrich, co-founder & CEO at 0g.ai, Mark Rydon, co-founder & CEO at Aethir, Nader Dabit, Director of Developer Relations at Eigen Labs, Anthony Lesoismier-Geniaux, co-founder at SwissBorg, Ethan Francis, Head of Developer Relationships at Particle Network and more committed to advancing decentralized AI solutions. The company aims to empower developers to build their own AI use cases using Assisterr’s infrastructure.

Assisterr is revolutionizing the AI landscape with its innovative approach to Small Language Models. Leveraging the Solana blockchain, Assisterr empowers communities to collaborate, aggregate, and monetize their data and expertise in specialized subjects. Small Language Models (SLMs) are tailored AI models optimized for efficient performance on edge devices focusing on specific domain tasks.

Since its launch, Assisterr has achieved major milestones, including attracting 150,000 registered users to its platform. Assisterr has also successfully launched more than 60 Small Language Models (SLMs) curated for leading Web3 protocols such as Solana, Optimism, 0g.ai, and NEAR. Additionally, the company has garnered recognition by winning multiple global hackathons, including the recent AI x Crypto event hosted by BeWater, OKX, and Binance Labs. Furthermore, Assisterr has been selected to participate in Google’s AI Startups program, securing $350,000 in funding that supports its GPU, CPU, and cloud infrastructure needs.

Nick Havryliak, CEO, and Co-founder at Assisterr shared the company’s vision: “At Assisterr, we are building an AI tokenization stack to ensure fair compensation for data owners and contributors. Our platform manages the entire lifecycle of SLM training, enabling features like data provenance tracking, fine-tuning, and the launch of SLM-powered Agents. Web3 component allows data-owners to contribute their data and expertise to domain-specific SLMs and capture the value from such contributions.”

Assisterr’s core technology stack

Small language models are neural networks trained on extensive text data sets. They are primarily designed to generate text resembling the patterns found in their training data. SLMs are smaller and more efficient than traditional Large Language Models (LLMs), capable of handling up to 8 billion parameters. Their deployment on edge devices including laptops and smartphones makes them ideal for applications where data privacy and efficiency are the need of the hour.

Assisterr’s core technology stack features several core components. The Data Provenance Protocol plays an important role in enabling decentralized coordination, ensuring the accuracy and reliability of domain-specific Small Language Models (SLMs). Their AI Lab incorporates intuitive no-code functionality, empowering users to seamlessly create, customize, and manage community-owned SLMs and SLM-powered Agents. Additionally, the SLM-Agent Marketplace serves as a platform for tackling distribution challenges by attracting early adopters and fostering growth within the AI ecosystem. These solutions support Assisterr’s commitment to advancing decentralized AI technologies while enhancing accessibility and innovation in AI model development and deployment.

With the influx of fresh funding, Assisterr will focus on several initiatives including protocol development and forming strategic partnerships to strengthen its infrastructure. The company also plans to drive ecosystem growth by launching an incentive program tailored for model builders and data contributors.

Additionally, Assisterr aims to enhance accessibility with the introduction of a no-code AI lab module, designed to attract a broader range of creative AI model builders to its platform. As Assisterr continues to expand, the platform’s primary objective is to enhance its infrastructure, broaden its support for additional use cases, and onboard the first million SLM-builders to the ecosystem.

About Assisterr.ai

A Cambridge-based startup building a Network of Community-Owned Small Language Models (SLMs). By leveraging the Data Provenance Protocol and providing an end-to-end infrastructure for launching and maintaining community-owned SLMs, Assisterr unlocks the value of aggregating human intelligence.

For more information, visit:

www.assisterr.com

https://x.com/assisterr

Blockchain

Folks Finance launches xChain testnet on Base, Avalanche, and Ethereum

Folks Finance, the largest DeFi app on Algorand, has launched the testnet for its next-generation xChain lending app. The testnet will be deployed on four major blockchain networks: Base, Avalanche, Arbitrum, and Ethereum.

The primary goal of the Folks testnet is to thoroughly assess and validate Folks’ crosschain framework, which aims to provide an intuitive, efficient, and flexible lending experience across multiple networks. Built using Chainlink CCIP, Wormhole, and Circle CCTP, Folks seeks to address the needs of a large cohort of DeFi users eager for crosschain innovation.

Try Folks’ testnet today, and get recognition within the Folks community with the Subway Riders Folks Campaign on Galxe. Check out the testnet guide for more information.

Regarding the mainnet release, Folks Finance has targeted the beginning of Autumn 2024. The testnet will allow the team to refine the protocol’s features and address any hiccups before the full-scale launch. Nonetheless, the team intends to move with purpose toward releasing a mainnet product in good time.

Folks’ team has been preparing for the crosschain expansion for over a year to ensure a smooth launch. The preparation includes security audits by Ottersec as well as a public community bug bounty on Immunefi worth $100,000.

The selection of Base, Avalanche, and Ethereum as the genesis networks was a key decision, and below are the reasons why those networks were chosen for day-1.

- Base, an Ethereum layer-2 built on the Optimism stack, offers high scalability and low transaction fees, making it an attractive option. Additionally, the ecosystem of Base is still in its early days, and Folks could provide invaluable lending infrastructure to accelerate the growth of the network and its DeFi scene.

- Avalanche, a high-performance blockchain, acts as the engine of Folks’ crosschain system. Its well-rounded strengths were a perfect match for the consistency Folks needs to power a comprehensive DeFi suite. With fast transaction finality, low fees, strong decentralization, and compatibility with the Ethereum Virtual Machine (EVM), Avalanche fit the bill for a day-1 network.

- Finally, Ethereum, the foundational blockchain for DeFi, serves as a crucial component, ensuring an onramp for the largest DeFi ecosystem. Dominating industry-wide TVL, Ethereum was a requirement for day-1 integration.

By launching the xChain expansion on these four networks, Folks is moving the industry toward solving the fragmentation problem in DeFi. The team’s aims to be the solution, bringing community and capital together by acting as a connective structure between isolated networks.

About Folks Finance

Folks Finance is a pioneering DeFi platform that offers a comprehensive suite of decentralized financial services, including cross-chain lending, borrowing, and trading. With a focus on security, efficiency, and user empowerment, Folks Finance is dedicated to reshaping the financial landscape by leveraging blockchain technology.

Blockchain

StakeVault.Network to Launch Validator Services for ETH, ATOM, TIA, and SUI

StakeVault.Network (SVN) is set to expand its validator services to major blockchain networks, including Ethereum (ETH), Cosmos (ATOM), TIA, and SUI, in the near future. This expansion aims to provide users with secure and efficient staking services, enhancing the security and performance of each network.

Discover StakeVault.Network

StakeVault.Network is a project dedicated to offering cutting-edge blockchain infrastructure. It provides validator services that support the operation and security of networks through user-held crypto assets. In today’s rapidly evolving blockchain technology landscape, there is a pressing need for secure, efficient, and scalable solutions for staking and node validation. These processes are crucial for strengthening network security, achieving consensus, and promoting decentralized governance across blockchain ecosystems.

Despite significant advancements, existing node validation and staking solutions often face scalability limitations, insufficient security measures, and a lack of user-friendly interfaces, hindering widespread adoption. StakeVault.Network aims to redefine the staking environment by introducing a robust, scalable, and secure platform to address these challenges, positioning itself as a game-changer in the industry.

Revolutionary Validator Solutions

StakeVault.Network offers comprehensive and customized solutions to address the challenges of staking and node validation. The platform implements advanced node authentication mechanisms to ensure that only reliable nodes participate, enhancing security through multi-factor authentication and continuous monitoring. Its efficient staking mechanism minimizes energy consumption while maximizing network security and participation, and a dynamic reward distribution model ensures fair and transparent rewards.

The user-centric design provides an intuitive interface and simplified staking process, encouraging broad participation. By promoting reliability and empowerment through a transparent economic model and community governance, StakeVault.Network supports the healthy development of the platform.

Expanding Horizons (ETH, ATOM, TIA, SUI)

SVN will provide validator services on the following major blockchain networks:

Ethereum (ETH): Founded by Vitalik Buterin in 2015, Ethereum is a decentralized platform with smart contract functionality. It serves as the foundation for decentralized finance (DeFi) and non-fungible tokens (NFTs), and many decentralized applications (DApps) have been developed on it.

Cosmos (ATOM): Cosmos aims to provide interoperability between blockchains with its native token, ATOM. It envisions an “Internet of Blockchains” and offers a software development kit (SDK) for creating independent blockchains.

TIA (Celestia): Celestia offers a modular blockchain focused on specific functionalities, addressing the trilemma of decentralization, scalability, and security. It uses Data Availability Sampling (DAS) for efficient block verification.

SUI: SUI is a layer 1 blockchain network designed for fast and low-cost transactions. It adopts the unique programming language “Sui Move.” SUI has expanded its ecosystem through partnerships with major companies.

Power of SVN Token

The SVN token is a crucial component of the StakeVault.Network ecosystem. Token holders can participate in decision-making processes and earn staking rewards in SVN tokens. Additionally, SVN tokens are used to pay for services and transaction fees, supporting the economic activities within the ecosystem.

About Us

Website: https://stakevaultnet.com/

Twitter: https://x.com/StakeVaultNet

Telegram: https://t.me/StakeVaultNetwork

Altcoins

ABTCOIN Trading Center: RWA Rebuilding a New Order for Cryptocurrency

The concept of Real World Assets (RWA) is increasingly capturing attention and sparking discussions in the cryptocurrency sphere. The emergence of RWAs presents new opportunities for the cryptocurrency market while challenging traditional financial system norms and models.

Traditional financial systems typically rely on centralized financial institutions to manage and trade real-world assets like real estate, stocks, and bonds. However, with the development of blockchain technology, RWAs are gradually entering the cryptocurrency domain, facilitating transactions and management through digital assets and smart contracts.

RWAs have significant impacts on the cryptocurrency market. On one hand, the support of RWAs can enhance the credibility and stability of cryptocurrencies. By linking real-world assets with cryptocurrencies, it provides asset backing, boosting investor confidence and attractiveness, thereby attracting more investors and institutions into the market. On the other hand, the introduction of RWAs may also lead to volatility and instability in the cryptocurrency market. Due to the relatively unstable nature of cryptocurrency markets compared to traditional financial markets, introducing real-world assets may result in significant market price fluctuations. Additionally, the slower process of trading and transferring real-world assets may impose certain limitations and impacts on the liquidity of cryptocurrencies.

Overall, RWAs have a dual impact on the cryptocurrency market. On one hand, they provide support and stability to the market, enhancing the credibility of cryptocurrencies. On the other hand, they may also contribute to market instability and fluctuations. Therefore, careful consideration of their effects and appropriate measures to manage risks are necessary when introducing real-world assets into the cryptocurrency market.

Against this backdrop, ABTCOIN Trading Center has been actively responding to market changes by introducing various new trading instruments, including mainstream cryptocurrencies like Bitcoin and Ethereum, as well as promising emerging digital currencies. These new trading instruments provide investors with more investment opportunities, facilitating better asset allocation. Additionally, ABTCOIN Trading Center places emphasis on community building by organizing online and offline events, seminars, and training courses in collaboration with industry experts and enterprises, collectively promoting the healthy development of the cryptocurrency market. This community-building effort not only provides investors with a broader perspective but also offers them more support and assistance throughout the investment process. The ABTCOIN Trading Center community also serves as a platform for investors to access the latest market dynamics and investment opportunities, while enabling them to share experiences and exchange insights with other investors, helping them to navigate challenges on their investment journey with confidence.

Altcoins

$ANDY Launched with the mission to “Make BNB Chain Great Again, CEX listing announced

Launched on June 15th on the BNB blockchain, $ANDY has experienced remarkable price growth. In less than a day, its market cap soared from a few thousand dollars to more than $17 million, capturing the attention of the crypto space.

It’s no longer rumours that $ANDY coin is going to be listed on popular Exchange Bitmart: and other leading exchanges would be coming onboard soon. https://x.com/BitMartExchange/status/1813719736049627616

But what is Andy? Or, more precisely, who is he? Andy is originally a character from Matt Furie’s Boy Club, the famous comics. He is probably the most unique character from Matt Furie and the best friend of Pepe the Frog, which also became one of the most important memecoins ever. Andy is really the character that glues the whole Boy’s Club together and is well known for being hilarious.

If you’ve been following some crypto news, you will know that two of the most important memecoins lately are Pepe and Brett, both coming from the Boy’s Club comics. Pepe is on the Ethereum Chain, while blue Brett is on the Base one. The great idea behind Andy is that this yellow character should be on the BNB Chain, also known as the yellow blockchain. It’s a simple yet very efficient narrative: if Brett was at the top of the Blue Base chain and Pepe at the top of Ethereum, then Andy should be at the top of the yellow BNB chain to complete this triforce of characters.

But it’s not all about the narrative; it’s also about the timing. $ANDY launched exactly at the right time. Trading on BNB has recently seen a significant resurgence in volume. This chain was historically known to be the most important chain during the last bull run for memecoins. It’s clear that Andy appears at the perfect time to capitalize on this momentum, help revive the BNB blockchain, and prepare the field for the next bull run where it will play an important part.

And because BNB has a historic significance for memecoins, Andy is also a heartfelt tribute to Changpeng Zhao (CZ), the founder of Binance, who is currently serving a four-month sentence. With his slogan of making the “BNB Chain Great Again,” it is evident that Andy is continuing CZ’s legacy and rallying every crypto enthusiast, wherever they are trading, to support this ideal.

Because of this timing and narrative, Andy immediately showed a lot of potential and can be compared only to Tier-1 category memecoins (those with the biggest communities, volume, and market cap). The numerous Andy memes surrounding the project, as well as their qualitative branding, contributed to its viral potential. Andy is catchy, and its story can be understood by anyone.

As with every memecoin, Andy’s marketing plays a big part, and the team has extensive connections to do this. We have seen that some of the biggest influencers in this space are supporting the project and recognizing its potential. On a daily basis, the marketing can be followed in their Telegram group. But every memecoin also needs a strong community, and $ANDY has that too. Of course, as it is very new, it has limited members, but the count is increasing rapidly, and the word is being spread on every social media platform to rally more members.

$ANDY is available on PancakeSwap, a decentralized exchange on the BNB network, without transaction taxes. It will also be listed on centralized exchanges, which, considering their tremendous trading volume, should happen very soon.

With a strong team, hilarious memes, extensive connections, the perfect narrative launched at the right time, and aggressive marketing, Andy shows promise. However, potential investors should conduct their own research before investing. Trade safely!!!

Socials:

TG: http://t.me/andycoinbsc

X: https://x.com/andycoinbsc

Website: http://andybnb.vip

Blockchain

Introducing Three Protocol: Building An Alternative To Centralized Digital ID’s and KYC with No-KYC Zero Knowledge Proof, Decentralized Digital ID’s

Three Protocol, a new project is building an alternative to centralized digital ID’s and KYC with no-KYC zero-knowledge proof, decentralized, digital ID’s (ZKi3s) in online marketplaces, announced its main features rivaling those of industry-established brands, such as Polygon ZKP, Starknet, zkSync, and DOP. The project aims to help users engage in secure, private digital interactions within a fully decentralized, trustless environment.

Zero-knowledge proof (ZKP) IDs are increasingly in demand in the emerging Web3 economy. Blockchain-based systems can ensure better performance and security in this landscape than the traditional Web 2.0 has to offer. Their focus on scalability, decentralization, and privacy offers a bridge for Web 2.0 online marketplaces toward Web3. Meanwhile, the latter’s reliance on national identification and KYC requirements affects user safety and privacy. Moreover, imposing verification excludes many from participating in online economic activities, especially those who are unbanked or lack proper identification.

Three Protocol eliminates KYC (Know-Your-Customer) or national identification requirements for marketplace access, allowing the unbanked and debanked communities to engage in online commerce. Signing up requires only a crypto wallet and the implementation of Zero-Knowledge Proof Psudoanonymised digital IDs. Therefore, a user’s profile on the blockchain is only a SHA256-hashed immutable entry on blockchain technology.

ZKi3s are no-KYC, zero-knowledge proof blockchain entries showing the owner’s online relationship history reputation, which forms the basis on which all Three Protocol systems function. Individuals can mint their own ZKi3s without providing national ID, biometric details, or passing KYC verification.

A ZKi3 is used to send ZK-Stark proofs between a review issuing protocol (e.g., an online marketplace) and an issuing protocol. This can occur whenever a user desires to collect a review or reputation score for any digital relationship or transaction. The ZKi3 is never visible publicly on the blockchain, ensuring the user’s transactions remain private.

Three Protocol confirmed that the algorithmic formulae for ZKi3s will be made open source. Therefore, any digital platform or online marketplace can integrate ZKi3s via a permissionless process.

Three Protocol also uses a Neural Network AI model employing cutting-edge alphanumeric AI algorithms to build a real-time updated product, a service, and a real-world assets interface for users. Furthermore, Three Protocol introduces the concept of DAIOs (Decentralized Artificial Intelligence Organizations) to implement open-source updatable AI systems and ensure users make informed decisions when voting.

ZKP ID providers take different approaches to the main aspects that define a ZKP ID system’s performance. These aspects include government access, privacy, KYC requirements, open-source nature, use of ZK-STARKs, and trustlessness. Here is how Three Protocol regards these manners and how it ranks against other leading projects, including Polygon ZKP, Starknet, zkSync, and Data Ownership Protocol (DOP).

Government Access

Three Protocol prioritizes the user’s control over their data and activities. Its decentralized ZKP digital ID technology maintains such sensitive information inaccessible to third parties. Besides Three Protocol, only a handful of other ZKP providers have this approach. On the other hand, projects like Polygon ZKP, zkSync, and DOP prioritize regulatory compliance over user autonomy and self-sovereignty.

Privacy

Three Protocol employs cutting-edge ZK-Stark technologies to guarantee the user’s identity remains anonymous. This feature sets this project apart from other similar initiatives. For example, Polygon ZKP considers its system’s scalability more important than keeping the user’s ID secret. Meanwhile, zkSync utilizes ZK-Rollups to prevent third-party access to user information but still requires KYC from its users. Lastly, DOP adopts a selective transparency and regulatory compliance policy and disregards user confidentiality.

KYC Requirements

One of the most appealing aspects of ZKP identification is that it often doesn’t require KYC verification. Three Protocol ensures its users enjoy this benefit and keep their sensitive information secret. Apart from Three Protocol and DOP, only a few other projects follow the same practice. At the other end of the spectrum, projects like Polygon ZKP, Starknet, and zkSync require users to pass Know-Your-Customer procedures, affecting user inclusivity and privacy.

Open Source Code

Three Protocol is among the industry’s top ZKP DID providers, along with Polygon ZKP, Starknet, and zkSync, maintaining an open source code. This feature allows the project’s growing community to contribute and scrutinize its development, thus enhancing its trustworthiness.

ZK-STARKs (Zero Knowledge Scalable Transparent Argument of Knowledge)

Three Protocol utilizes ZK-STARKs to provide security against privacy threats and enhance performance levels without affecting decentralization. Only a few other projects follow this practice, e.g., Starknet. However, more prominent brands, like Polygon ZKP, zkSync, and DOP, do not consider ZK-STARKs a priority.

Trustless

Three Protocol uses tri-signature smart contracts and DAO governance to ensure a fully decentralized and trustless experience. Moreover, it provides unbiased dispute resolution and self-custody, setting an industry standard with this approach, which only a few other brands, such as Starknet and zkSync, also follow.

About Three Protocol

Three Protocol is Tectum Labs’s first incubated project. Its mission is to modify the current paradigms of online marketplaces through decentralization and create financial inclusivity for individuals without access to traditional banking services.

The project uses the Three Protocol Neural Network AI model to create marketplaces that increase the efficiency and accuracy of searching for products, services, real-world assets, and clients based on personalized user queries.

Three Protocol integrates cryptocurrency utility to broaden the purchasing power and utility of cryptocurrency holders. Its implementation of an AI-driven DAO should also help increase equity and fairness in the user-online marketplace relationship.

Lastly, Three Protocol uses a unique blend of privacy, self-custody, and decentralized governance that sets it apart from other ZKP ID providers. Its services cater to users and developers who value anonymity, trustlessness, and decentralization.

Blockchain

Data Ownership Protocol – Itheum – Launches on Solana, Embracing AI and Gaming

Itheum, a data ownership protocol, has unveiled ItheumV2, emphasizing AI and gaming data, and is now expanding on the Solana blockchain. This expansion began with the release of Data NFTs on Solana, allowing users to participate in the Get BiTz meme-burning game to collect BiTz XP, which contributes to Proof of Activity within the ecosystem. This activity is later converted to Liveliness Scores, backed by $ITHEUM tokens, meaning that each user will get $ITHEUM tokens proving their Liveliness Score. The inaugural GetBiTz version on Solana was launched via DRiP, and of course, more opportunities for participation will be dropped via the same channel in the future, all you need to do is to subscribe/follow and make sure you’re securing a BiTz Data NFT drop when the time comes.

Following the successful deployment on Solana, Itheum secured the 5th position at the Solana Summit, marking a huge milestone for the development of the protocol on the Solana Network. The next step is to onboard gamers to the Gamer Passport when it launches and for this, we invite you to read more and stay up to date with the Itheum developments to make sure you’ll be able to join the Gamer Passport Alpha Stages.

Omni Chain Expansion Debuts with the Launch of the Itheum on Solana

A significant milestone in Itheum’s expansion is the launch of the Omni Chain Token Bridge between Solana and MultiversX blockchains, now live on mainnet. This has been done after a series of QA tests and security audits by xAudits with a full public report available on their official website. The $ITHEUM token is accessible on both blockchains, with strong liquidity pools on platforms like xExchange and Raydium as the primary DEXs (more coming soon), offering community access to the native token through various ways.

Initially launched on the MultiversX blockchain, Itheum introduced Data NFT technology aimed at onboarding diverse content creators—musicians, writers, educators, podcasters, game developers, on-chain analysts and more. This technology enables creators to bridge their work into the web3 space, offering a way to create fractionalized ownership over their work.

Fans can support creators by owning pieces of those collections and enjoying the content which is unlocked directly inside the NFT. Itheum also developed the Itheum Explorer platform, a tool that allows anyone to visualize the Data NFT in a human-readable form. This platform features a music player, arcade game zone, and educational widgets and more, allowing creators to share their work as Data NFTs. As an infrastructure layer on MultiversX, various protocols have built applications on top of Itheum, including a Loyalty Aggregator App for trading cashback as Data NFTs, a Social Media app for minting interactions as Data NFTs, and Data Aggregators.

ItheumV2 Empowers Gamers to Earn with Data NFTs in New AI-Driven Narrative

ItheumV2 introduces a new narrative: Data for the AI Era. Starting with the Omni Chain expansion, mainnet bridge release, and Raydium liquidity pool launch, Itheum aims to enable gamers starting with Sony PlayStation users to link their gaming data to Data NFTs and monetize it for passive income. More platforms like Xbox or Stream will be included later on. Gamers can link their gaming data to a Data NFT, regularly check in their data enriched with user survey answers like mood and feelings, and add it to an aggregator creating a bulk data pool. This pool can be traded with AI companies and other interested parties, generating passive income for active gamers.

Interactive Music Experiences: Itheum’s Data NFTs Enable Dynamic Playlists and Transparent Royalties

Other achievements include the Music Data NFT technology on Solana, enabling musicians to create dynamic playlists wrapped in a single Data NFT. Artists can update the content within the NFT, offering interactive experiences for fans while maintaining ownership over their work. Fans can access the content as long as they own a copy, and artists can generate a transparent form of revenue through on-chain royalties with each trade. Platforms like music and video streaming services can utilize Data NFT technology, revolutionizing content ownership and enhancing social media interactions for content creators and fans, creating more unique experiences for everyone, all this made possible via technology provided by the Itheum Protocol.

Business

Wirex and Visa Expand Partnership to Drive Web3 Payment Adoption

Wirex, the leading Web3 money app, and Visa, a world leader in digital payments, are thrilled to announce a partnership to further the use of digital currencies in the UK and the European Economic Area (EEA).

This collaboration will explore new opportunities to leverage and integrate innovative Visa cards and reduce friction in payment experiences. By combining the strengths of both companies, consumers will have the trust and confidence of Visa’s payment network with Wirex’s product innovation.

A major highlight of this partnership is the launch of Wirex Pay, the modular Zero Knowledge (ZK) payment chain incubated by Wirex. Wirex Pay is designed to revolutionise how users manage and spend both crypto and traditional currencies. This innovative product aims to simplify transactions, offering a seamless way to handle funds. It showcases fintech innovation by enabling seamless transactions between blockchain technology and traditional finance.

Wirex proudly stands as a crypto-native company holding Visa principal license capabilities for card issuance. Together, Visa and Wirex are committed to developing projects that integrate blockchain technology with traditional financial systems, ensuring smooth and efficient transactions. As such, Visa will support Wirex’s growth in existing markets through enhanced marketing efforts, leveraging Visa assets and capabilities.

Sviatoslav Garal, Global Head of Payments at Wirex, remarked, “Being among the few crypto-native companies licensed by Visa for card issuance, and notably the first principal member of Visa Network in Europe, emphasizes Wirex’s pioneering role in the financial industry. At a time when the financial world is boldly moving towards Web3 and decentralisation, the need for robust solutions for global funds movement remains essential. Key ecosystem players like Visa play a tremendous role in this shift. Wirex, a renowned innovator in both Web3 and traditional finance, is thrilled to partner with Visa in bridging the gap between these two spaces.”

“Partnering with Wirex to help integrate blockchain technology with traditional finance, including the launch of Wirex Pay, aligns closely with our vision for the future of payments while highlighting the importance of collaboration in driving fintech innovation,” said Cuy Sheffield, Head of Crypto at Visa.

About Wirex

Wirex is a prominent UK-based digital payments platform with over 6 million customers spread across 130 countries. It offers secure accounts, making it easy for users to store, purchase, and exchange multiple currencies seamlessly.

As a principal member of both Visa and Mastercard, Wirex goes beyond traditional services, embracing the evolving trends of Web3 to provide mainstream access to digital finance and wealth management.

Having processed transactions totalling $20 billion, Wirex aims to contribute to the adoption of a cashless society by facilitating straightforward transactions in various currencies worldwide. Wirex is simplifying digital payments, making it more accessible and convenient for people across the globe.

-

Blockchain3 weeks ago

Blockchain3 weeks agoHinkal announces ‘EigenLayer for Privacy’ with the upcoming launch of the Shared Privacy Protocol

-

News3 weeks ago

News3 weeks agoCwallet Expands Crypto Loans Landscape | Marking a New Era of Success in Lending

-

Altcoins2 weeks ago

Altcoins2 weeks agoNOWPayments expands crypto payment options with LayerZero ($ZRO) and ZK Token ($ZK)

-

Technologies2 weeks ago

Technologies2 weeks agoDiscover the Future of Trading with AXL Finance

-

News2 weeks ago

News2 weeks agoAibit Launch Garners Industry Attention, Poised to Become a Rising Star

-

Altcoins2 weeks ago

Altcoins2 weeks agoThe Covalent Network Successfully Migrates to New CXT Token to Drive Deeper Innovation in AI Following Governance Vote

-

Business2 weeks ago

Business2 weeks agoWirex and Visa Expand Partnership to Drive Web3 Payment Adoption

-

Blockchain1 week ago

Blockchain1 week agoData Ownership Protocol – Itheum – Launches on Solana, Embracing AI and Gaming