Blockchain

The Next Big Thing In NFT: The DeFi Infrastructure For Utility NFTs

2021 was a ‘Year of Renaissance’ for NFTs. From the mainstream perspective of the market, after the crypto cat project boomed in 2018, NFTs finally in 2021 ushered in a concentrated outbreak where many flourished. On the one hand, Opensea has taken the lead in NFTs trading, forming a blue-chip phalanx of NFTs led by CryptoPunk, BAYC, Coolcat and other projects. On the other hand, GameFi projects represented by Axie Infinity combines NFTs with DeFi, successfully bringing the brand-new economic model of Play to Earn to the mainstream market. In the great bull market, NFTs succeeded in overtaking the curve to attract main market funds, and it has become an important asset class in the blockchain world. Since 2022, the NFTs market has inevitably been affected by the macro market condition. After the frenzy, market participants began to rethink the fundamentals of the NFTs track: What will be the future of NFTs? What will be the next NFTs hotspot?

The current NFTs market can be classified into at least two relatively independent categories: Digital collectibles and utility NFTs. Most PFPs would fall into the former category, whose value comes from the scarcity, hence the valuation is very much subjective. Utility NFTs are quite different as the valuation is supported by their intrinsic value.

GameFi assets are an iconic example of utility NTFs. The value of GameFi assets can be clearly quantified based on the potential cash flow value derived from the P2E tokenomics. Thus, DeFi infrastructure is potentially very relevant to the utility NFTs with a similar significance as to the fungible token assets.

Shape The Markets: An Overview Of DeFi Infrastructure

So how would the DeFi infrastructure be built in the NFTs market? We can look at the DeFi world. Based on the magnitude of significance, we can easily identify the four most essential pillars that support the whole DeFi world: Uniswap, AAVE/Compound, Synthetix, and YFI. But why?

The formation of any financial market would not be possible without the maturity of the following 4 markets First, a market that sufficiently discovers the price of assets is fundamentally essential for the purpose of price provision on all levels of liquidity. Secondly, a market that sufficiently discovers the interest rate of assets that gives an answer to the question “how can we effectively price various levels of risk in this market”. Then, based on the two aforementioned markets, a series of derivative instruments can be created for investors to manage their leverage, thus adding more liquidity to the market. Finally, there comes the aggregator, which gathers the assets and liquidity scattered around the market to lower the barrier to entry of the market. And as a result, more liquidity would be injected into the market. Through the whole process, a basket of ‘mainstream assets and the ‘anchor of value’ (DAI or USDC) would also be discovered and widely adopted.

Available DeFi Infrastructure for Utility NFTs

Compared to the more established DeFi markets, infrastructure for utility NFTs. OpenSea being the primary NFTs marketplace, the trading mechanism, however, is based on order book model. The efficiency of such a matchmaking mechanism is low. It might be a viable solution for low liquidity digital collectibles with subjective valuation, but is clearly not servicing the purpose of continuous price discovery for utility NFTs very well.

Since the value of utility NFTs is derived from the inherent value of cash rewards in Play-to-Earn scheme, the mechanism designed for lending and borrowing utility assets is significantly different from the logic of token asset loans. It is more similar to a finance leasing or rental business in the real world where the ‘right to use’ can be transferred without any change of ownership. The implementation of the ‘right to use’ function in a decentralized manner for NFTs has become a big challenge.

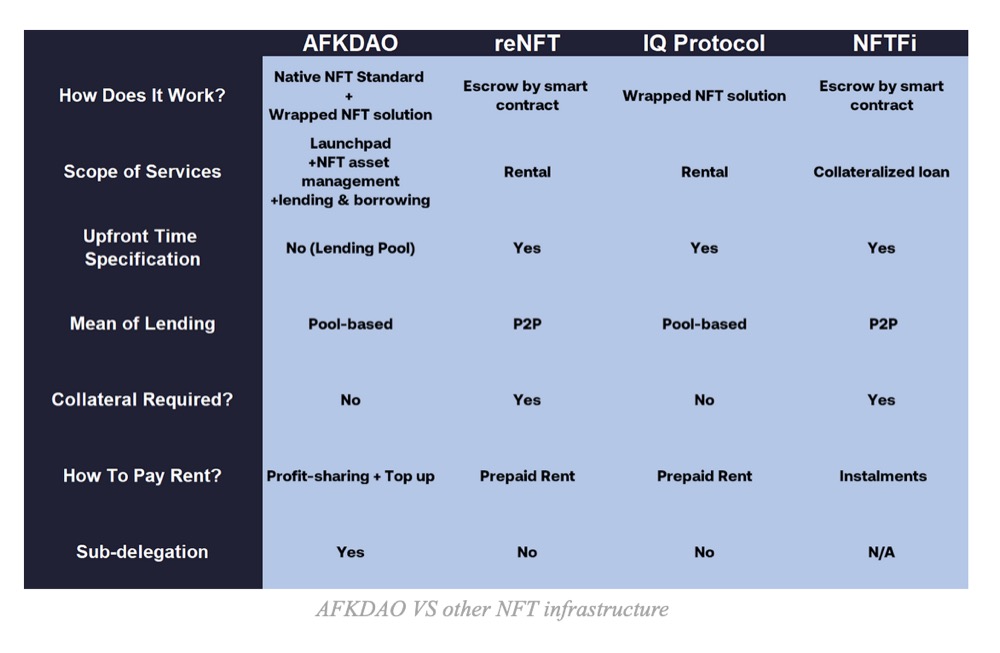

Luckily, some projects have already started offering innovative solutions to this problem. We will discuss the pros and cons of each of these projects in several aspects.

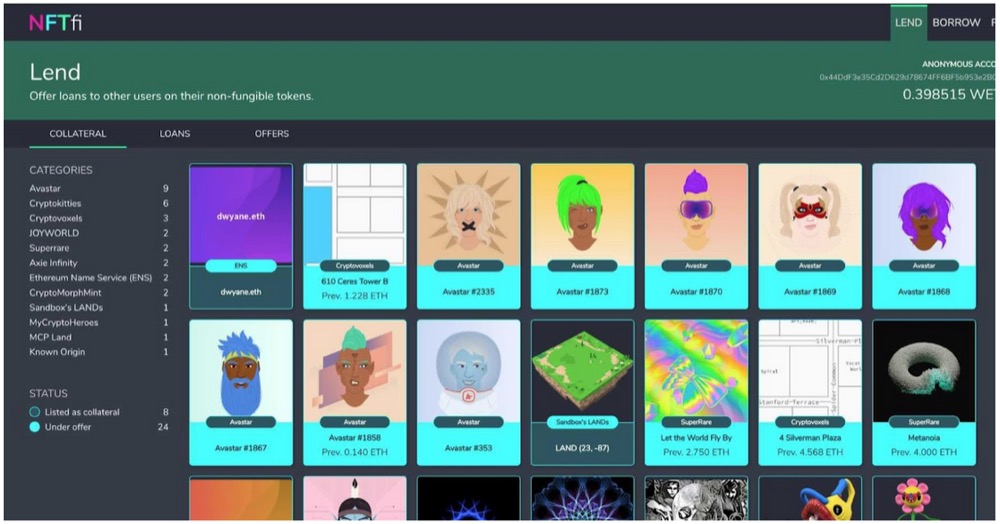

NFTFi

Launched in June 2020 by Stephen Young, NFTFi is a marketplace for NFT mortgages. It allows users to deposit NFTs as collateral to borrow crypto assets such as ETH or WDAI.

How It Works?

As an NFTs mortgage platform, NFTFi allows borrowers to deposit accepted NFT assets as collateral for issuing a loan amount from platform. The renter will set the duration schedule of the loan as well as the interest rate, and the borrower has to follow the terms of agreement. The lender is able to claim collateral assets if the borrower breaks the contract.

Strengths and Weaknesses

NFTFi provides a platform for NFT assets holders to collateralize their NFTs and obtain loans in a decentralized way. This platform is implemented by smart contracts with very simple liquidation mechanisms. For example, if collateral asset value fails to cover the borrowing amount of assets, it occurs liquidation.

The platform enables holders of NFTs to access liquidity with collateral. However, the core issue is how to determine the price of NFTs reasonably. The NFTs price market is highly volatile, and due to the poor liquidity of the NFT assets, the floor price of NFTs can drop significantly and trigger liquidation. In this case, the borrowers will suffer a loss very easily. To prevent that, the borrowers will always leave a huge buffer premium, and this significantly reduces the fund-use-efficiency.

We can draw the conclusion that NFTFi’s protocol is not a perfect solution to solve liquidity problems for utility NFTs.

reNFT

reNFT is a leasing platform which NFT assets holders can lease out their assets and receive rental revenue over the lease period of the assets. From the NFTs borrowers’ point of view, if there is a temporary need for some particular NFT assets, instead of buying they are able to rent out suitable NFT assets through this platform.

How it works?

Borrowers are required to clarify the lease schedule in advance and transfer the corresponding lease fee and collateral (the value should be equal to the NFTs assets price) into the third-party escrow smart contract. When the borrower returns the NFTs by requirements, the collateral is also returned. If the borrowers fail to return the NFTs, the collateral will be paid to the renter as compensation. The price of the collateral is obtained by Chainlink from the OpenSea platform. The collateral will also be used to generate interest on the AAVE which increases the fund-using-efficiency.

Strengths and Weaknesses

reNFT proposes a solution for NFT lending and borrowing, which brings value to idle NFTs and enables cash flow. It aggregates assets from renter and borrower through an escrow smart contract, thus allowing asset security for both.

However, the liquidation mechanisms require collateral and occupies high rate in capital to prevent liquidation. Secondly, the renter and borrower must pre-determine the lease schedule and pay upfront. The leasing method is based on peer-to-peer matching which is low efficiency.

IQ Protocol

IQ Protocol is a DeFi tool introduced by PARSIQ whose main role is to provide the framework that enables controlled rentals of assets in the form of Time-limited wrapping.

How it works?

IQ Protocol has not yet officially launched, but from the information in its white paper, IQ Protocol will try to wrap an NFT into a rentable wNFT. The asset will lock up ownership as it is lent, leaving the borrowers of the asset with only the right to use but not the right to sell or transfer. With this approach, there is no liquidation mechanism during the process as it effectively avoids the risk of losing the NFT itself.

Strengths and Weaknesses

The solution proposed by IQ Protocol is well suited to the practical needs of utility NFTs, i.e., the transfer of usage rights while ownership remains unchanged. The entire lending approach will be realized by wNFT liquidity pool, and its lending efficiency is greatly enhanced compared to the P2P approach.

However, since wNFT itself is a Time-limited NFTs derivative, IQ’s leasing solution still requires both renter and borrower to pre-determine the leasing schedule and pay the rental fee in advance when the lending occurs. Another issue with IQ Protocol is for applications that rely on recording on-chain interaction data within the NFTs, such as fully decentralized games. The Wrapping and Unwrapping processes may lead to lost or incoherent on-chain data within the NFTs.

AFKDAO

AFKDAO is a DeFi infrastructure solution for the utility NFTs, introduced by Ben Gothard’s team in late 2021 and announced its SDKs on Github in early 2022.

It was first applied to Play-to-Earn projects which helps to provide a life-cycle lending and liquidity solution for GameFi assets.

How it works?

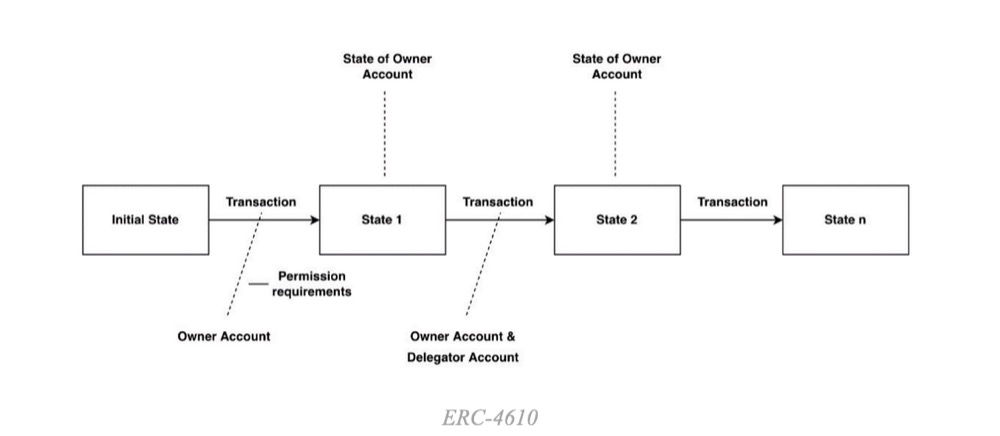

The solution is based on the new ERC-4610 protocol which is an extensible protocol for NFT assets developed by AFKDAO. Erc-4610 is designed to be fully compatible with the NFT format ERC-721. A holder of an ERC-4610 NFT can issue the right of usage to others, without relying on any third-party platforms/smart contracts.

The approaches of implementation are available for ERC-4610:

1. ERC-4610 native NFT

2. A wrapper solution for the existing ERC-721 NFTs

ERC-4610 also activates another use case of utility NFT assets: on-chain NFT asset management and profit distribution.

In the case of P2E games, the protocol allows the lending of GameFi NFT assets to others, while all the rewards are managed by smart contract, which can be divided among multiple parties in predetermined proportions.

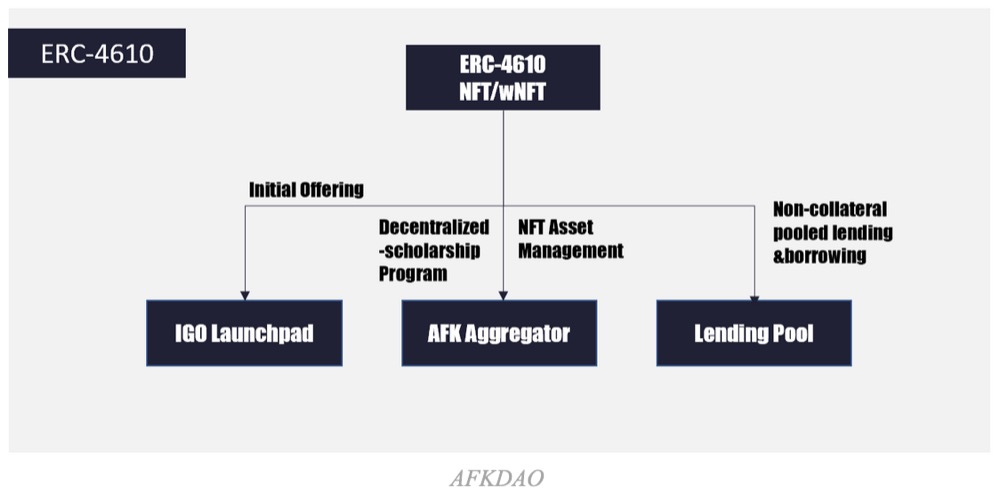

The AFKDAO comprises 3 modules: NFT Launchpad, AFK Aggregator and NFTs Lending Pool. Through these three products, AFK tries to explore a sufficient pricing mechanism for utility NFTs.

Any assets launched on the AFK Launchpad must be ERC-4610-compatible, either being ERC-4610 native NFTs or wrapped into ERC-4610. The Play-to-Earn mechanism must be open on the sale day, and a vault would be required to open in order to make ROI stats available to the community. This enables the buyers to discover a reasonable price range for NFTs before and after the sale, which helps to prevent hype-speculation which sets high barrier to entry of the projects.

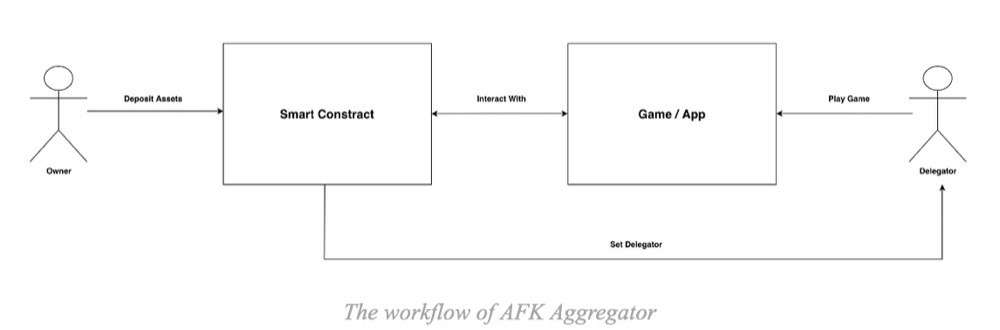

The AFK aggregator is a YFI-like fund management protocol but for NFTs. It aggregates utility NFT assets in a fully decentralized way powered by ERC-4610.

When it comes to the P2E game use cases, AFK Aggregator enables the players or guilds to raise NFT assets for the purpose of profit generating and sharing fully on-chain by setting up a ‘vault’ and defining the details of the raise. NFT owners simply need to stake to delegate the guilds to manage their NFTs. All profits will be returned to the ‘delegator smart contract’ for automatic distribution to all parties related onchain, eliminating the need for third-party escrow or private key transfer.

The whole delegation process requires zero need for collateral as well as any upfront payment for using the NFTs. The AFK Aggregator also allows the fundraiser to subdelegate scholars, which supports the guild management needs to enable the delegation of assets to multiple addresses at the same time.

The NFTs lending pool is comparable to AAVE or Compound, which is a pooled lending and borrowing liquidity solution for NFT assets. Eligible ERC-4610-compatible NFT assets can be staked into the pool at any time for revenue while borrowers are enabled to borrow NFT assets at any time without any collaterals as long as there are enough NFT assets in the pool. Borrowers would be required to stake relevant tokens as the ‘top-up’ where interest costs will be deducted from (eg. $SLP for Axie pool, $GEAR for PlaceWar Tank pool). The interest rate will be calculated in real-time by block via the algorithm based on the supply and demand situation of the pool. When the top-up by a borrower is depleted by costs incurred, the lease will be terminated.

Strengths and Weaknesses

AFKDAO provides a relatively comprehensive DeFi infrastructure solution for utility NFT assets.

It put forward a preliminary solution to the price discovery and interest rate discovery for long-tailed utility NFTs. AFKDAO adds an access control to NFTs to separate the use right from ownership, which helps to maximize the fund utilization rate and efficiency.

At this stage, the utility NFT market is still in its early stage, AFK’s solution mainly focuses on Play-to-earn games, and more time is needed for big traction. As the scale of the utility NFT market expands, it is believed that products like AFKDAO will gain much larger adoption.

Find out more about AFKDAO on its official sites:

Website: https://afkdao.io/

Telegram: https://t.me/AFKDAOANN

Discord: https://discord.gg/p878yn6yzr

Twitter: https://twitter.com/AFK_DAO

Blockchain

XION Pioneers User-Friendly Blockchain Solutions with Latest Chain Abstraction Release

XION, the first blockchain purpose-built for mainstream adoption, today launched its user-friendly Chain Abstraction solution. XION’s Chain Abstraction combines XION’s ease-of-use with seamless composability of users, apps, and liquidity across connected blockchains, beginning today with Injective.

XION aims to make Web3 easier to navigate for all users by abstracting away its inherent complexities. Through familiar Web2 methods like email, users can seamlessly interact with XION applications across all devices, including desktop and mobile. Users can also enjoy a frictionless experience reminiscent of traditional Web2 platforms without the concerns associated with blockchain technology, such as gas fees. Today’s Chain Abstraction launch serves as an extension of these functionalities to other connected blockchain ecosystems.

“Just like the internet, users shouldn’t need to know which infrastructure applications they are using are built on. All that matters is that it works,” said Burnt Banksy, a core contributor to XION. He added, “We’re proud to launch Chain Abstraction as it vastly accelerates XION’s impact in making Web3 accessible to all users.”

Previously, cross-chain usability has been notoriously difficult for users to navigate and has resulted in fragmentation across ecosystems. However, with Chain Abstraction, XION aims to reshape the historically competitive nature of L1s – who typically fight for users, liquidity, and developers – to enable mainstream adoption. Through the inaugural integration with Injective, users can utilize Talis with their XION account, without needing to grapple with complexities such as cross-chain bridging, browser plugins, seed phrases, gas fees, and transaction signing.

XION will progressively roll out its user-friendly Chain Abstraction to many more ecosystems. Interested users can try XION’s Chain Abstraction on testnet today.

About XION

XION is the first layer one blockchain purpose-built for consumer adoption through crypto abstraction. Utilizing protocol-level implementations related to abstracted accounts, signatures, fees, interoperability, and more, XION enables secure, intuitive, and seamless user experiences. The project has previously raised over $32M from top-tier investors, including Animoca, Circle Ventures, Multicoin, Draper Dragon, Spartan, and more.

To learn more about XION, follow @burnt_xion on Twitter, or visit xion.burnt.com.

Blockchain

Saakuru Leads the Gasless Blockchain Revolution, Disrupting the Industry

Saakuru announced some recently reached milestones in its development, which put it at the forefront of the gasless blockchain revolution currently disrupting the industry. The consumer-centric L2 protocol entered the top 5 brands in its niche within 9 months of launch. Moreover, according to data from DappRadar, it records over 1.44 million/week.

Saakuru is preparing for the official launch of its Saakuru token ($SKR) before the end of April. The project also successfully raised $2.4 million in an oversubscribed private funding round to develop its protocol.

The Saakuru Protocol is an up-and-coming proponent of gasless technology, considered by many an accelerator of Web3 adoption into the mainstream. Its mission is to improve the user experience for both developers and end users and drastically reduce costs. These enhancements should forever change the blockchain landscape, enabling the development of more versatile decentralized applications boasting higher security standards, cost-effectiveness, and ease of use.

As of 2024, blockchain technology is stagnating and used mainly for crypto trading. Also, the broadly adopted Ethereum model, based on gas fees fluctuating depending on network use, can lead to high costs and a disappointing user experience. Lastly, most blockchain networks face significant security issues, deterring new users from onboarding promising projects.

Saakuru has developed a public-permission, gas-less L2 blockchain powered by Oasys High-Speed Optimistic Rollups. The network’s design eliminates gas fees, significantly improves user experience, and proposes new tokenomics models. For instance, it enables the easy creation and execution of token contracts, including features like vesting, staking, data tracking, and management. This approach differs significantly from most layer-2 blockchain networks, which rely primarily on governance tokens.

The Saakuru token is a multi-purpose token ensuring utility and governance for the Saakuru Protocol. It uses an advanced burning mechanism to gradually reduce its supply while potentially increasing its value. The token is involved in all the operative layers of the Saakuru protocol:

- Developer Layer—Also known as Saakuru Labs, this feature provides several products and services with proprietary business models. The system burns the token with 10% of the profit.

- DeFi Layer — This feature is facilitated by Taffy DEX technology, and 0.005% of every fee collected from on-chain and cross-chain transactions throughout the Taffy DEX protocol is converted to SKR tokens and burned.

- Governance Layer — SKR token holders can use their tokens to participate in the protocol’s governance model. Moreover, 5% of the tokens used to initiate the review process are burned.

- Protection Layer — The SKR token is burned if the SKR token protection mechanism is triggered, and 3% of saved tokens will be burned.

The Saakuru team believes the protocol’s gas-less operations will drive quick and consistent adoption of the SKR token. Moreover, developers can stake their SKR tokens to refill their credit balances monthly and drive the ecosystem’s growth.

Another aspect that should increase demand for gas-less blockchain networks like Saakuru is the outdated properties of the currently available external wallet model. The Saakuru team believes developers and users will soon adopt the embeddable model, defined by increased security and numerous configurable features in any mobile app in one day. This type of wallet can provide a better, user-friendlier experience without reducing security.

The Saakuru protocol will also feature prebuilt, easy-to-launch modules for basic Web3 interoperability functions, such as smart contract event tracking and interaction APIs. It will also have an NFTs CRM and zkNFTs verification layer, allowing businesses to integrate Web3 technologies seamlessly into their operations.

About Saakuru

Saakuru takes a new, innovative approach to Web3 and proposes a blockchain that doesn’t charge gas fees, maintains stability through top security practices, and fosters new projects, applications, and ideas. To this end, the team launched the Saakuru Developer Suite, a comprehensive toolset that includes libraries and APIs and enables developers to create applications faster.

The development team behind Saakuru has more than ten years of experience making Web2 products and six years of experience in Web3 applications, both from the developer’s and business sides. Their experience enabled them to discover the primary issues of decentralized production that prevented them from reaching mainstream use.

Saakuru benefits from increasing support from the industry, including prominent educators on blockchain technology, such as Ivan on Tech, an angel investor in the Saakuru Protocol.

Blockchain

Linea Going from Strength to Strength with Lynex on the Front Lines

The Linea blockchain has gone from strength to strength over the last quarter, seeing TVL and volume soar. Lynex and its ingenious community engagement strategy stand as a key contributor to this organic growth.

This impressive achievement highlights the strength and potential of the Linea ecosystem, a product of the renowned blockchain software houseConsenSys, which is also known for owning the popular cryptocurrency wallet MetaMask. With its lattice-based cryptography, which is faster, less computationally heavy and easier to implement than other cryptography methods, Linea is a key player in the market of Layer 2 scaling solutions for Ethereum.

Linea has seen mass organic growth with TVL tripling over the last trimester and volume quadrupling in the last month. Part of this growth has been thanks to the community efforts in bolstering liquidity and driving engagement, coordinated by Lynex, the leading DEX and native liquidity layer on Linea.

Lynex, the top DEX on the network boasts an elevated rendition of the ve(3,3) DEX model and has contributed greatly to the organic growth and engagement on the network, with TVL on the protocol seeing a 1600% increase in the last month at the time of writing. Through a community-centric airdrop mechanism, Lynex is incentivizing investors to explore the ecosystem to use other protocols, to maximise their chances of airdrop, which has proven to be quite an effective tactic in driving growth.

Lynex’s Recent Milestones

The surge in TVL is a testament to the increasing confidence and interest from the DeFi community in the Linea blockchain and its associated projects, particularly Lynex. The platform has played a crucial role in this growth, thanks partly to its strategic community airdrop, which has successfully attracted a wider user base and fostered a more engaged and vibrant community.

A total of 10% of Lynex’s initial supply has been earmarked for distribution to holders of existing ve-like protocols and those who have actively engaged with the Lynex community. This strategic airdrop is a testament to Lynex’s dedication to fostering a strong, engaged, and empowered community, and truly embodying the role of being a native liquidity layer. Lynex aims to create a more inclusive and collaborative ecosystem that benefits all stakeholders by rewarding our users for their loyalty and participation.

Lynex has also been named the official DEX partner of Linea’s much-celebrated community coin, FOXY. This partnership comes after Lynex had seen mammoth growth in TVL and token price over the last quarter and solidifies its place at the top of the food chain in the Linea ecosystem.

Lynex’s Innovative Tokenomic Model Helps Drive Growth

Lynex continues leading the way in DeFi innovation with its advanced Automated Liquidity Management (ALM) and unique tokenomics. The ALM feature allows users to optimize their liquidity provision, reducing the risks associated with impermanent loss and ensuring more stable and profitable returns. Meanwhile, Lynex’s tokenomics model is designed to align the interests of liquidity providers, token holders, and the broader ecosystem, creating a more sustainable and rewarding platform for all participants.

Lynex’s innovative tokenomics model, oTokenomics, is revolutionizing the DeFi ecosystem by addressing critical challenges such as token devaluation and incentive misalignment for Liquidity Providers (LPs). This model aligns user and protocol interests, ensuring long-term stability and growth.

The “Darkpool” Is Coming

Lynex is also set to disrupt the liquidity provision landscape very soon by introducing its groundbreaking ‘Darkpool’ technology on the Linea blockchain. Developed in collaboration with security experts at Salus Security, this cutting-edge innovation promises to bring unparalleled privacy to the trading world.

By leveraging the power of zero-knowledge proofs, zkLynex’s Darkpool technology ensures that traders can execute their transactions with complete confidentiality, protecting both their strategies and market positions.

About Lynex

Lynex is a leading decentralized exchange (DEX) and liquidity marketplace built on the Linea blockchain. With a focus on innovation, security, and user experience, Lynex aims to provide a seamless and efficient trading platform for the DeFi community. The platform features advanced technologies such as Automated Liquidity Management (ALM), innovative ve(3,3) DEX model and tokenomics, and soon, Darkpools for enhanced privacy in trading.

About Linea

Linea is a Layer 2 blockchain developed by ConsenSys, the company behind MetaMask. It offers a scalable and secure platform for EVM decentralized applications (dApps) and decentralized finance (DeFi) projects. Linea’s rapid growth and increasing Total Value Locked (TVL) reflect its potential to become a leading blockchain for DeFi and beyond.

Blockchain

Swirlds Labs Brings Open Source HashioDAO Framework to the Hedera Network, Making DAO Formation Simple, Accessible, and Inclusive for All Web3 Communities

Swirlds Labs, the team providing development and support for the Hedera network, has released HashioDAO — an open-source, user-friendly interface for creating and managing decentralized autonomous organizations (DAOs) on Hedera. HashioDAO makes it easier for communities to form, govern, and operate DAOs efficiently, using Hedera’s underlying technology. It can cater to various governance needs, responding to the need for decentralized, transparent decision-making tools that diverse communities can easily adopt.

Communities looking to establish DAOs for decentralized governance have often faced extensive technical and financial complexities. HashioDAO provides an interface that simplifies the creation and management of DAOs for users, without requiring extensive technical expertise, leveraging Hedera’s enhanced security and performance capabilities. It streamlines the management of DAOs through a web app that guides users through the entire process of launching a DAO, simplifying the technical aspects while leaving decisions and control over structure, governance, and management to the DAO creators. Users will be able to access the open-source HashioDAO code directly on Github. Swirlds Labs will also offer a free, community-hosted version of HashioDAO to support adoption and ensure accessibility.

HashioDAO offers DAO creators user-friendly access to features such as customizable governance tokens, multi-sig options, and treasury management, enabling communities to easily adopt decentralized governance models suited to their specific needs. For example, HashioDAO users can adopt token/NFT-based voting and proposal creation, without needing prior technical expertise. Emphasizing transparency, inclusivity, and participation, HashioDAO will foster greater participation in decision-making processes.

Dr. Leemon Baird, Co-Founder of Hedera and Swirlds Labs, said, “Traditional decision-making mechanisms within organizations often lack transparency and are inefficient. This reduces the trust and engagement of community members. Not only that, but setting up a DAO from scratch can be a daunting task. It can be technically complex, and require a great amount of knowledge, and development resources. We will change that with the release of HashioDAO. This simplifies establishing a DAO, to make it as simple as possible, to allow any organization or community to quickly and easily create new organizations with democratic governance.”

The release of HashioDAO follows on from other free services that Swirlds Labs has brought to Hedera in the past including the HashScan ledger explorer and the Hashio JSON-RPC relay.

About Swirlds Labs

Swirlds Labs was established with the mission to accelerate the future, built on Hedera – the most used, greenest, enterprise-grade public ledger for the decentralized economy. Our vision is to enable ‘Shared Worlds’, where anyone can gather, collaborate, conduct commerce, and control their own online footprint. We will enable this vision by continuing to provide development and other support for the Hedera network, building community and enterprise solutions that enable fast, rapidly scalable adoption of Hedera network services, and cultivating ‘moonshot’ projects that will change the way humans and organizations interact in cyberspace.

Blockchain

Paragon Network Unveils Test Net, Showcasing Breakthrough Capabilities in Decentralized Computing

Excitement fills the air as Paragon Network, the pioneering force in decentralized computing, announces the launch of its highly anticipated Test Net. This significant milestone marks a pivotal moment in the evolution of Paragon Network, as it solidifies its position as a leader in the realm of Layer-1 protocols for smart contracts.

“We’re thrilled to announce that our Test Net is now live, and we extend our gratitude to the $PARA community for their patience,” says a representative for Paragon Network. “Paragon Network stands as a Layer-1 protocol for smart contracts, employing a sharded proof-of-stake (PoS) system capable of processing up to 1000 transactions per second.”

Paragon Network is not just another blockchain project; it’s a game-changer in the world of decentralized computing. Combining a modular, EVM-compatible Layer 1 infrastructure with a Delegated Proof-of-Stake (DPoS) consensus mechanism, Paragon Network offers users unparalleled security, scalability, and accessibility.

The Test Net rollout showcases Paragon Network’s commitment to innovation and excellence. With efficient sharding technology at its core, Paragon Network offers unmatched scalability and performance, capable of processing transactions at lightning speed while maintaining full compatibility with Ethereum’s infrastructure.

Transactions within Paragon Network aren’t settled directly on Ethereum. However, the network preserves full compatibility with Ethereum’s infrastructure. The native token of Paragon Network, $PARA, facilitates this compatibility, thanks to efficient sharding technology, significantly reducing the computational demands of running a node on the network.

As Paragon Network gears up for its official launch, the team remains focused on its mission to establish a decentralized chain dedicated to distributing cloud computing power and forming the Cloud Computing Alliance (CCA). By hosting all other cloud computing networks on ETH and migrating them to #PARAGON, Paragon Network aims to revolutionize the cloud computing industry.

“We’re entering an exciting new era of decentralized computing, and Paragon Network is at the forefront of this revolution,” concludes the Paragon Network team. “We invite enthusiasts, developers, and enterprises alike to join us on this journey towards a future powered by decentralized technology.”

To join the Paragon Network Test Net and experience the future of decentralized computing firsthand, use the following information:

- Network Name: Para Test

- RPC: http://65.109.19.70:8545

- Chain ID: 1993

- Currency Symbol: PARA

- Explorer: http://65.109.19.70:4000

Paragon Network is more than just a project; it’s a movement toward a future where decentralized technology is accessible to everyone. Join us as we revolutionize the world of cloud computing and GPU network tokenization with Paragon Network.

For more information about Paragon Network and how to get involved, visit Paragon Network’s official website at https://networkparagon.io/. To be a part of the Paragon Network community, join the official Telegram channel at https://t.me/Network_Paragon.

About Paragon Network

Paragon Network is a decentralized computing platform that aims to democratize access to decentralized technology. With its modular, EVM-compatible Layer 1 infrastructure and DPoS consensus mechanism, Paragon Network offers users unparalleled security, scalability, and accessibility. By integrating Real-World Assets (RWA) and employing AI-driven security measures, Paragon Network is revolutionizing the landscape of cloud computing and GPU network tokenization.

Website: https://networkparagon.io/

Blockchain

ICB Network Enters New Era of Blockchain Technology With Advanced Layer 1 Project

During this crucial period for the crypto industry, ICB Crypto Services is ready to announce the early launch of the Ideal Cooperation Blockchain (ICB) Network. Designed by the sophisticated ICB Labs, the ICB Network introduces a promising Layer 1 blockchain project that was created to update the standards of scalability, security, and efficiency in the blockchain space. The ICB Network effects a sufficient advancement in blockchain innovation, with an official ICO-level launch scheduled for Q1 2024.

Transformative Innovations

The adoption of the Proof of Stake (PoS) consensus mechanism is at the core of the ICB Network’s innovation. It is a strategic move away from traditional Proof of Work (PoW) systems. This transition enhances transaction throughput and network scalability, and significantly reduces the environmental footprint of blockchain operations. Furthermore, the ICB Network is aimed at ensuring advanced security and efficiency, collaborating with leading auditing companies like CertiK, and implementing comprehensive Know Your Customer (KYC) processes.

Bright Future Ahead

“The ICB Network is set to revolutionize blockchain innovation with its PoS consensus, scalability, and commitment to security. Our platform provides developers and users with a robust infrastructure for building and using decentralized applications across various industries,” stated CEO of ICB Crypto Services.

This vision encapsulates the essence of the ICB Network’s mission to motivate developers and users, creating a more inclusive and efficient blockchain ecosystem.

Expansive Roadmap and Collaborative Endeavors

Looking forward, the ICB Network has outlined an extended roadmap that includes the introduction of trading activities, play-to-earn games, metaverse functionalities, a native wallet, and an NFT Marketplace. These components, in combination with strategic partnerships with developer communities, underscore the network’s commitment to boosting innovation and collaboration. Moreover, the plans are underway for the listing of the ICB Network’s native coin, ICBX, on centralized and Tier 1 exchanges, further solidifying its presence in the blockchain industry.

About ICB

Established in October 2020, ICB Labs represents the innovative arm of ICB Crypto Services, dedicated to addressing the challenges faced in the blockchain and cryptocurrency sectors. Through the use of cutting-edge technologies and adherence to the Ethereum Virtual Machine (EVM) standard, ICB Labs has developed the ICB Network to facilitate efficient, secure, and scalable blockchain solutions. The launch of the ICB Network signifies a major milestone for ICB Crypto Services, marking its entry into the blockchain industry with a vision to drive positive changes and promote a new era of digital excellence.

For more information about the ICB Network and its innovative solutions, visit the official website at https://www.icb.network/ or follow the latest updates through the network’s official channels:

X/Twitter: https://twitter.com/icbx_network

Telegram: https://t.me/icbnetwork_official

YouTube: https://youtube.com/@icbcryptoservices?feature=shared

Discord: https://discord.com/invite/rGRUgrbC4D

Medium: https://readicbnetwork.medium.com/

Blockchain

Introducing BounceBit Testnet Phase 2: App Store

Following the success of BounceBit Testnet: BounceClub East-to-West Event launched on March 8, 2024, BounceBit announces the rollout of BounceBit Testnet Phase 2: App Store.

While the previously launched Testnet BounceClub Event will operate as usual without any changes, BounceBit Testnet Phase 2 highlights BounceBit App Store’s features and encourages developers to deploy on the BounceBit Testnet by submitting their decentralized applications (DApps) to the BounceBit App Store through GitHub pull request.

BounceBit Testnet Phase 2 mirrors the mainnet environment, offering developers, validators, full node operators, delegators, and users an early preview of the BounceBit Mainnet. This phase welcomes everyone to interact with the BounceBit PoS staking chain and the BounceClub ecosystem.

Here’s what you can expect from BounceBit Testnet Phase 2:

Deploy on BounceBit testnet

BounceBit Testnet Phase 2 offers developers the chance to get an early experience of deploying on the BounceBit chain by submitting their DApps to be listed on the BounceBit App Store. The BounceBit App Store features both in-house DApps and those built by community developers or external projects. To have your DApp listed on the BounceBit App Store, submit a pull request on BounceBit’s GitHub repository. The BounceBit team will then review and, if approved, list your DApp on the BounceBit App Store. DApps that are listed during Testnet Phase 2 will receive priority consideration for being listed on the BounceBit Mainnet App Store based on their performance.

For more details on the onboarding process, please refer to BounceBit’s official guide.

Stress-testing DApps

BounceClub owners and users are invited to participate in testing all DApps that are listed on the BounceBit Testnet App Store. BounceClub owners can select and add DApps to their BounceClubs, while BounceClub users can interact with the DApps when exploring different BounceClubs.

The BounceClub community plays a crucial role in evaluating the listed DApps’ performance and security, identifying vulnerabilities that need to be addressed. This Testnet Phase 2 contributes to the resilience and reliability of the BounceBit ecosystem, striving to maintain a smooth and secure environment for all BounceBit users.

Onboarding more validators

The BounceBit Testnet has kicked off with its first set of node operators during the BounceClub East-to-West Event. Currently, there are 24 active validators participating, with a combined staking amount totaling over 1000 $BBTC and over 283 million $BB.

For Testnet Phase 2, BounceBit aims to broaden the network by inviting more validators to participate. New validators will be guided through the onboarding process for Phase 2 via Discord.

Testing BounceBit’s tokenomics

BounceBit Testnet Phase 2 will continue the rigorous testing of BounceBit’s tokenomics, including token generation events (TGE), inflation rates, vesting schedules, gas fees, block sizes, and the validator slashing mechanism. Additionally, the BounceBit native LSD module’s performance will be observed continually.

About BounceBit

BounceBit is building a BTC restaking infrastructure that provides a foundational layer for different restaking products, secured by the regulated custody of Mainnet Digital and Ceffu. The BounceBit chain, designed as a showcase of a restaking product within the BounceBit ecosystem, is a PoS Layer 1 secured by validators staking both BTC and BounceBit’s native token – A dual-token system leveraging native Bitcoin’s security with full EVM compatibility. Critical ecosystem infrastructure like bridges and oracles are secured by restaked BTC. Through an innovative CeDeFi framework, BounceBit empowers BTC holders to earn yield across multiple networks.

Blockchain

MVC unveils testnet version of game-changing Bitcoin sidechain asset bridge

The Bitcoin ecosystem has recently been in the spotlight, with the emergence of innovative solutions such as the BRC20 concept and the continuous evolution of applications that captivate the market’s interest. This resurgence evokes memories of the DeFi summer of 2020 on the Ethereum network, where decentralized applications thrived alongside a surge in token prices, setting the stage for high expectations for the Bitcoin ecosystem. In a significant development, the much-anticipated Bitcoin ecosystem application, MicrovisionChain (MVC, Ticker $SPACE), has announced the testnet version of its cross-chain asset bridge feature, marking a game-changing milestone for the Bitcoin sidechain.

Developed through a collaboration between the MVC technical team and the Octopus Space team, the Orders Bridge is now a part of the MVC ecosystem. Currently, the Bridge facilitates cross-chain transactions exclusively from the Bitcoin network to the MVC network. MVC stands as one of the top three global Bitcoin sidechain solutions in terms of hash power and boasts impressive technical features, including smart contracts on UTXO public chains, low fees with high concurrency, and high throughput. Previous reports suggest that MVC can support nearly unlimited transactions per second (TPS).

By bridging assets to the MVC network, users can leverage the numerous advantages offered by the network’s features, effectively overcoming many limitations associated with transactions on the native Bitcoin network. The MVC solution offers significant cost savings, as cross-chain transaction fees to MVC are reported to be one five-hundred-thousandth of the peak rates on the Bitcoin network. Moreover, due to MVC’s network characteristics, transactions feature zero-block confirmations, eliminating network congestion and block confirmation delays as obstacles to trading. Unlike other Bitcoin cross-chain solutions, assets bridged to MVC remain based on the UTXO layer1’s Tokens, significantly reducing the risk of “fake Tokens.”

Beyond its groundbreaking asset bridge, Orders.Exchange also encompasses an order book DEX, Swap, and liquidity pools within its ecosystem. The platform gained widespread attention for being the first in the network to support a complete range of trading order types. It enables the trading of any Bitcoin asset, including Ordinals NFTs and BRC20 tokens, through the creation of ASK and BID orders. This approach ensures that the immediate trading needs of both buyers and sellers can be met. Notably, Orders.Exchange is the only platform in the Bitcoin ecosystem that supports the construction of BID orders, distinguishing it as a unique service provider in the space.

In its Swap and liquidity pool solutions, Orders.Exchange demonstrates strong technical capabilities and a commitment to decentralization and asset security. According to information disclosed by the team, its Swap and liquidity pool frameworks are built on a decentralized architecture. This framework splits users’ orders into several parts, each handled by different modules within the framework. Some modules solely process user operation data without touching the transaction data, while others are dedicated to allocating funds based on the orders without interpreting the transactions themselves. The modules operate independently without sharing data, significantly reducing the potential for losses due to hacking attacks. Impressively, this complex logic is executed within a single block, meaning Swap transactions only require confirmation in one block.

The liquidity pool is particularly critical, as it holds a significant amount of user assets, and inadequate security could expose users to financial risks. Orders.Exchange employs cold and hot wallet segregation along with a threshold multisignature approach for fund management. In the hot wallet (online environment), Orders.Exchange stores only a minimal amount of assets necessary for basic services. Assets exceeding this threshold are transferred to the cold wallet (offline environment), which replenishes the hot wallet only when its assets fall below the threshold.

To isolate cold and hot wallets, Orders.Exchange uses a threshold multisignature method to eliminate all potential internal misconduct. For the hot wallet, a 2/3 threshold multisignature is used, meaning three parties hold the multisig private keys, and any transaction requires signatures from at least two of them to proceed. The cold wallet employs a 3/5 threshold multisignature, underscoring a heightened emphasis on asset security. The institutions involved in the multisignature management are well-known security audit firms, each with a reputation to maintain. Known participants include sCrypt, a reputable Bitcoin network audit firm, and Scalebit, which has officially announced its audit work. Notably, Orders.Exchange plans to co-host a public seminar on asset security with the renowned audit firm Certik in early April.

With the multitude of positive developments surrounding Bitcoin and the approaching halving event, there is every reason to believe that the potential of the Bitcoin ecosystem is fully comparable to that of the Ethereum ecosystem at its inception. At this juncture, closely monitoring the movements within the Bitcoin ecosystem becomes particularly crucial. Orders.Exchange stands out as the most technically accomplished platform with already implemented functionalities, and we believe it possesses significant potential, heralding a new era for Bitcoin sidechain solutions.

Twitter: https://x.com/mvcglobal

TG: https://t.me/mvcofficial

Blockchain

Xpence: Innovative cryptocurrency wallet with pharming capabilities

Xpence is a cryptocurrency wallet that not only provides secure storage and management of assets, but also provides unique opportunities for earning money using pharming. Cryptocurrency farming is a process where users can register their assets on the platform and earn profits in the form of interest over a certain period of time. Xpence offers two types of farming, each of which has its own characteristics and advantages.

Farming for Xpence: Opportunities and Advantages

First type of farming: Duration 10 days

This type of pharming allows users to earn profits within 10 days. The range of possible profits is from 43.5% to 45.9% per month, which represents a significant return in a short period of time. This type of farming is ideal for those who prefer to receive fast and high profits in a short period of time.

Second type of pharming: Duration 90 days

For those who prefer longer-term investments, Xpence offers farming with a duration of 90 days. In this case, users can expect a profit range of 51% to 51.66% per month. This type of farming provides more stable and predictable income over a longer period of time, which can be attractive to investors seeking long-term profits.

Advantages of farming for Xpence

- High Returns: Both types of farming offer a high range of returns, making them attractive to investors looking to maximize the return on their assets.

- Variety of Choices: Users can choose between short-term and long-term farming depending on their investment goals and preferences.

- Transparency and reliability: Xpence provides transparent pharming conditions and guarantees the safety of users’ assets, making it a reliable choice for investment.

Conclusion

Farming on Xpence opens up unique opportunities for users to make money on cryptocurrency assets. With a variety of options and high returns, these instruments provide an attractive solution for those seeking to effectively manage their cryptocurrency investments. However, it is important to be aware of the risks associated with investing and make informed decisions based on your own financial goals and circumstances.

Blockchain

Monitok Unveils Points program to promote self-custody between crypto users

Vilnius, Lithuania, March 18, 2024 — Monitok, a next-gen self-custodial exchange that combines features of both decentralized and centralized trading platforms, recently announced its Monitok rewards program. To celebrate their new project’s launch, the team is giving away 10,000,000 points. This announcement further hints at a future token airdrop from the pool of 100,000 USD worth of cryptocurrencies.

Joining the Monitok waitlist provides participants with a unique referral link, which they can use to earn Monitok points by sharing it and referring their contacts. These 10,000,000 points are not only transferable across different incentivization campaigns within Monitok, but can also be accumulated through active engagement with the project. These points represent a potential future investment, as they can be converted into MNT tokens upon launch.

What is the objective of the campaign?

At the core of Monitok’s referral campaign is the goal to create a strong community of people who share a vision of one of crypto’s main principles: ownership of assets.

How to join?

- Sign up to the Monitok waitlist

- Receive a personalized referral link

- Invite friends, family, and followers to join the waitlist

- The more people you invite, the more Monitok points you accumulate, which will be convertible into MNT tokens after the token’s launch

MNT tokens are a cornerstone of the Monitok ecosystem, designed to facilitate transactions, reward participation, and encourage investment within the platform. Additionally, users can acquire MNT tokens through active engagement with the app. Furthermore, MNT tokens can be utilized for payments or to obtain discounts on services, access premium features, or generate yield through staking.

“Our mission is to fill up the gap between DEX and CEX by inviting more people to embrace self-custody. “

Why Participate?

. By joining the waitlist and participating in the referral program, members can:

- Gain early access to the app: Secure early access to the platform and take advantage of its benefits.

- Split 10,000,000 Monitok points with fellow participants: Gather Monitok points, by engaging with the community and platform.

- Secure a spot in $100,000 worth of MNT token airdrops: Convert your points to MNT tokens during airdrops.

To ensure a fair and transparent experience for all participants, Monitok has meticulously prepared the terms and conditions of the referral program. These guidelines define the dos and don’ts of the referral process, ensuring a rewarding and enjoyable campaign for all.

About Monitok

Monitok, established in 2022, is a hybrid crypto exchange with self-custody as its key feature. As the first hybrid crypto exchange built on the Arbitrum Network, Monitok is committed to helping users trade smarter by providing a secure, one-stop-shop crypto trading solution. The platform enables users to manage their assets in self-custodial wallets and access the best token rates by aggregating over 100 decentralized exchanges. Additionally, it provides easy fiat on and off-ramps and plans to launch a crypto debit card. Through its referral program, Monitok encourages the adoption of self-custodial trading, rewarding members for their support.

For more information, visit:

Website | Twitter | LinkedIn | Discord | Telegram

Or contact: [email protected]

-

Business3 weeks ago

Business3 weeks agoCardano Spot & TapTools Join Hands For News & Data Sharing

-

Technologies3 weeks ago

Technologies3 weeks agoRaindex Launches On Flare To Power Decentralized CEX-Style Trading

-

News2 weeks ago

News2 weeks agoChangelly surpasses 7 million users, celebrating its 9th anniversary

-

Business2 weeks ago

Business2 weeks agoNew Collaboration: IPMB Partners with Sumsub for Enhanced Security and Customer Experience

-

Blockchain3 weeks ago

Blockchain3 weeks agoSwirlds Labs Brings Open Source HashioDAO Framework to the Hedera Network, Making DAO Formation Simple, Accessible, and Inclusive for All Web3 Communities

-

Altcoins2 weeks ago

Altcoins2 weeks agoXuirin Finance a pioneer for DeFi card – presale stage 1 sold out

-

News2 weeks ago

News2 weeks agoEtherland Tecra Space Crowdfunding Goes Live

-

News2 weeks ago

News2 weeks agoCovalent (CQT) Announces Grants Program & API Credits for Cronos Ecosystem, Supercharging Future Web3 Innovation